There are many MSME support schemes in India. The Indian government continues to empower micro, small, and medium enterprises (MSMEs) and startups through multiple direct financial support schemes.

These programs provide easy and collateral-free loans, subsidies, seed capital, and credit guarantees to boost entrepreneurship, especially among women, SC/ST entrepreneurs, artisans, and new innovators.

This article presents a comprehensive guide on the key government schemes available to small business owners today along with practical eligibility, latest beneficiary data, and how digital initiatives have eased access.

MSME Support Schemes A Snapshot

| Scheme | Benefits | Eligibility | Helpline |

| PMMY | Collateral-free loans up to ₹20L | Indian citizens 18-65, MSMEs | 1800-223-922 / 1800-202-4455 |

| CGTMSE | Govt guarantee up to ₹2 cr | Registered MSMEs (no defaults) | 1800-222-659 |

| Stand-Up India | Loans ₹10L-1 Cr for SC/ST / women | SC/ST/women entrepreneurs 18+ | 1800-180-1111 / 1800-11-0001 |

| SISFS | Seed funds up to ₹50L for tech startups | DPIIT-recognized startups | 1800-115-565 |

| PMEGP | Subsidy on loans up to ₹25L/₹10L | New MSMEs, individuals, SHGs | +91-7526-000-333 |

| SIDBI MSME Loans | Soft loans, 59-min online loan approval | Registered MSMEs/startups | 1800-222-399 |

| CLCSS | 15% subsidy on machinery loans | Registered manufacturing MSMEs | 1800-115-565 |

| PM SVANidhi | Working capital loans ≤ ₹50,000 | Registered street vendors | 1800-111-979 |

| NSIC Schemes | Raw material, machinery, marketing support | Registered MSMEs | 1800-115-565 |

| Agriculture Infra Fund | Loans & grants for farm infrastructure | Agri startups, FPOs, cooperatives | 011-2430-6315 |

Read: How To Get An Udyam Aadhar Card For Your Business?

Government MSME Support Schemes – Eligibility and Latest Data

Pradhan Mantri Mudra Yojana (PMMY)

PMMY provides collateral-free loans up to ₹20 lakh to support micro and small enterprises, classified under Shishu, Kishor, Tarun, and Tarun Plus categories.

It channels loans through banks, NBFCs, and microfinance institutions to encourage entrepreneurship across urban and rural India.

- Eligibility: Indian citizens 18-65 engaged in trading, manufacturing, services, or allied agriculture with operational business or startup plans.

- Official Website: mudra.org.in

- Helpline: Toll-free 1800-223-922 / 1800-202-4455

Credit Guarantee Fund Trust for Micro & Small Enterprises (CGTMSE)

CGTMSE offers a government-backed guarantee on loans up to ₹2 crore, enabling MSMEs unsecured credit access from banks with minimal collateral requirements.

- Eligibility: Registered micro and small units excluding pure agriculture and education; must not be loan defaulters.

- Official Website: cgtmse.in

- Helpline: 1800-222-659

Stand-Up India Scheme

Aimed at SC/ST and women entrepreneurs, it provides loans from ₹10 lakh to ₹1 crore for setting up greenfield enterprises in manufacturing/trading/services.

- Eligibility: Individuals 18+ years, first-time entrepreneurship ventures where 51% ownership is by SC/ST or women.

- Official Website: standupmitra.in

- Helpline: 1800-180-1111 / 1800-11-0001

Startup India Seed Fund Scheme (SISFS)

SISFS supports idea-stage and early startups with seed funding up to ₹50 lakh to promote technological innovation and product commercialization.

- Eligibility: DPIIT-recognized startups less than two years old with ≥51% Indian ownership and minimal prior government funding.

- Official Website: startupindia.gov.in

- Helpline: 1800-115-565

Prime Minister’s Employment Generation Programme (PMEGP)

Credit-linked subsidy scheme incentivizing new MSME units and self-employment projects with loan amounts up to ₹25 lakh for manufacturing and ₹10 lakh for services.

- Eligibility: New micro-enterprises owned by individuals, SHGs, and cooperatives; educational qualification required at higher loan brackets.

- Official Website: udyam.org.in / kviconline.gov.in

- Helpline: +91-7526-000-333

SIDBI MSME Loans (SMILE, 59-Minute Loan)

SIDBI schemes offer soft loans for modernization, expansion, and working capital with some loans approved digitally within 59 minutes for amounts up to ₹5 crore.

- Eligibility: Registered MSMEs/startups with viable business plans.

- Official Website: sidbi.in / psbloansin59minutes.com

- Helpline: 1800-222-399

Credit Linked Capital Subsidy Scheme (CLCSS)

Supports MSMEs in tech and machinery upgrades by providing 15% capital subsidy on loans up to ₹1 crore for adopting modern technology.

- Eligibility: Registered manufacturing MSMEs.

- Official Website: dcmsme.gov.in

- Helpline: 1800-115-565

PM SVANidhi (Street Vendor Loan Scheme)

Provides easy working capital micro-loans (up to ₹50,000) to street vendors for sustaining and expanding their businesses.

- Eligibility: Registered street vendors with valid certification.

- Official Website: pmsvanidhi.mohua.gov.in

- Helpline: 1800-111-979

National Small Industries Corporation (NSIC) Schemes

NSIC offers raw material, machinery credit, marketing support, and equity assistance to MSMEs to enhance operational efficiency and market presence.

- Eligibility: Registered MSMEs with viable business projects.

- Official Website: nsic.co.in

- Helpline: 1800-115-565

Agriculture Infrastructure Fund (AIF)

Provides loans and grants to agribusinesses, startups, and FPOs for infrastructure facilities like warehouses, cold storages, and marketing infrastructure.

- Eligibility: Individuals, cooperatives, FPOs engaged in agri-infrastructure development

- Official Website: agriinfra.dac.gov.in

- Helpline: 011-2430-6315

Other Important Schemes to Note

- PM Vishwakarma Scheme: ₹13,000 crore package supporting artisans & craftsmen’s tech upgradation and market access.

- Aatmanirbhar Bharat Rojgar Yojana (ABRY): Government pays EPF contributions for new employees hired by MSMEs, supporting labor cost subsidies.

- MSME Sustainable (ZED) Certification: Promotes energy-efficient, zero-defect manufacturing practices in MSMEs.

- Market Access Initiative (MAI): Helps MSMEs with export promotion and participation in international trade fairs.

Read: Mahila Samman Savings Scheme and How to Open an Account

Latest Statistical Insights

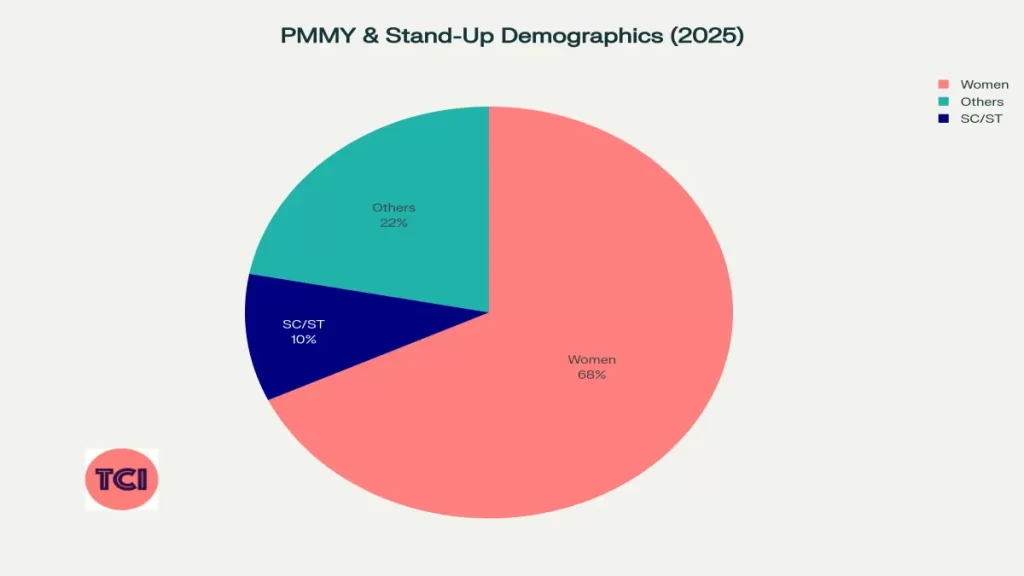

- PMMY: Over 52 crore loans totaling ₹32.6 lakh crore disbursed, with women beneficiaries making up 68% of recipients.

- Stand-Up India: Loans exceeding ₹40,600 crore granted to over 1.8 lakh SC/ST and women entrepreneurs.

- CGTMSE: Guarantees worth ₹10.8 lakh crore facilitating collateral-free loans for MSMEs.

- SIDBI: Approximately 2.4 lakh MSMEs funded annually, with some loans approved in under an hour digitally.

- PMEGP: Supported substantial rural employment through subsidized loans clustered around ₹25 lakh for manufacturing and ₹10 lakh for service enterprises.

Digital Access and Ease of Application for MSME Support Schemes

- Most schemes are integrated with portals like Udyam Registration, Startup India Dashboard, and JanSamarth for easy online application.

- E-loan approvals in schemes like SIDBI’s 59-Minute MSME Loan vastly reduce processing times.

- Dedicated helplines and mobile applications provide real-time assistance and status tracking.

Practical Use Cases

Pradhan Mantri Mudra Yojana (PMMY)

The scheme has supported over 34.93 crore entrepreneurs with ₹18.39 lakh crore in loans since inception. A notable story is of a flour mill owner in Tamil Nadu who using Mudra loans moved from daily wage earner to employing 4 people, expanding his business.

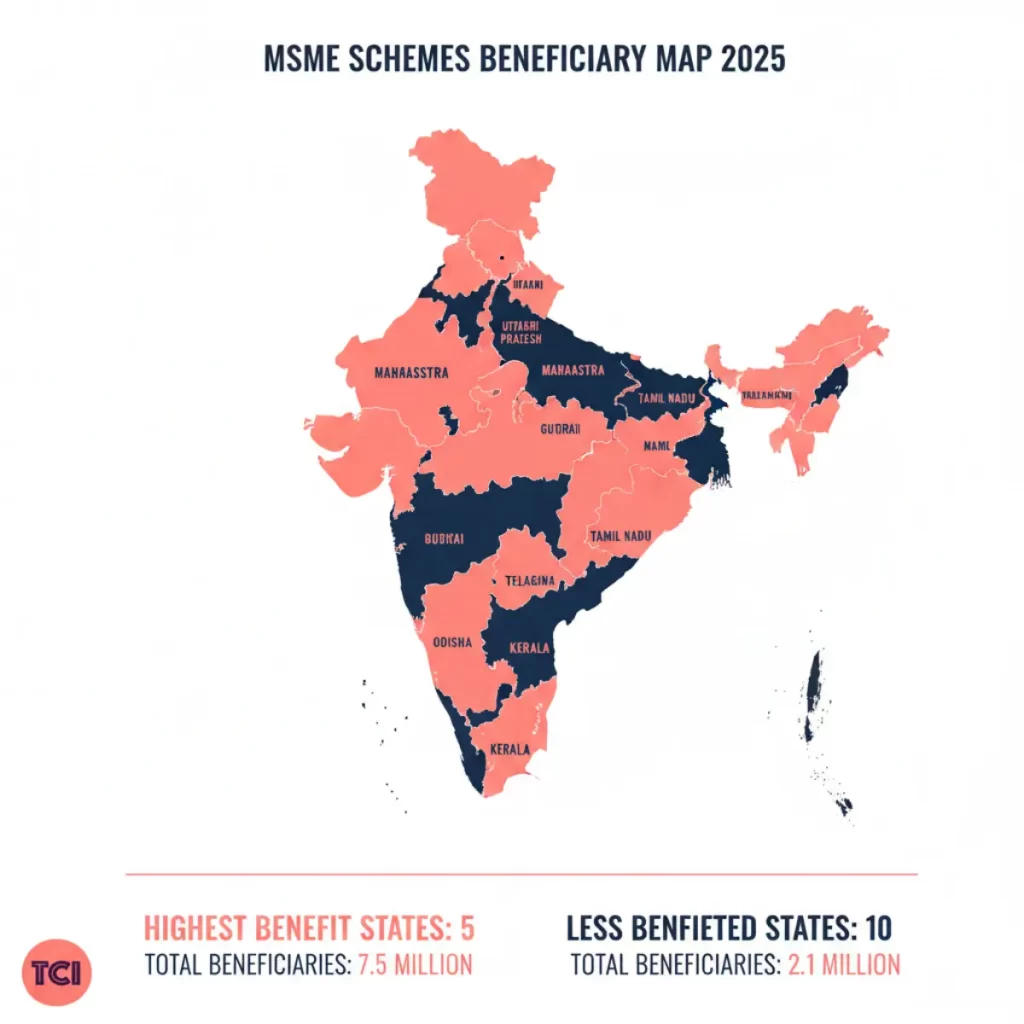

The scheme has significantly increased loan disbursal in underserved regions like Bihar, UP, and Northeast India, spurring grassroots entrepreneurship nationwide.

Stand-Up India

The scheme has benefited 1.8 lakh+ SC/ST and women entrepreneurs with loans worth over ₹40,600 crore as of early 2025

For example, Sonalben Rupara from Surat secured a ₹39 lakh loan to launch an embroidery manufacturing enterprise, which now employs 5-8 people. This showcases empowerment of women entrepreneurs and job creation in tier 2/3 cities.

Myth Busting

- Not all schemes require collateral; PMMY and CGTMSE offer collateral-free options.

- Schemes are not limited to urban areas; many target rural, tribal, and underserved regions.

- Application processes have been simplified digitally; physical paperwork is minimal or optional.

Training, Capacity Building & Support Services

- Many schemes are complemented by skill development initiatives like Entrepreneurship Skill Development Programme (ESDP) and MSME Technology Development Centers.

- Incubators and mentor support are offered under Startup India and PM Vishwakarma for capacity enhancement.

Government Support Schemes For MSMEs – FAQs

Can startups with prior govt funding apply for SISFS?

No, startups that have received more than ₹10 lakh government funding are ineligible for SISFS but may apply for others like Mudra.

Are collateral-free loans available in all schemes?

No, PMMY and CGTMSE specifically offer collateral-free loans; others may require margins or guarantees.

Is business turnover or experience mandatory?

Most schemes do not require turnover; some like Mudra prefer operational history, and PMEGP requires minimum education for larger loans.

What documents are typically needed?

Aadhaar, PAN, business registration, photographs, project report, and sometimes educational proofs are mandatory.

Does educational qualification affect eligibility?

Yes, PMEGP requires 8th pass for bigger projects; others mostly do not have minimum educational criteria

Redefining India’s Growth Story

The Indian government’s extensive network of MSME and startup schemes offers abundant direct financial support in 2025.

These programs accelerate small business growth, entrepreneurship inclusiveness, and overall economic development through simplified digital access, strong funding models, and complementary capacity-building efforts. Small business owners should stay informed and leverage these schemes to scale efficiently in today’s competitive market.

You May Also Like

- Top Corporate And Government Job Portals In India

- Telangana Government Schemes

- Full List Of Karnataka Government Schemes

Tamil Nadu Bank Holidays 2026 – The Complete List

Tamil Nadu Bank Holidays 2026 – The Complete List List of Bihar Ministers – Nitish Kumar’s 10th Ministry

List of Bihar Ministers – Nitish Kumar’s 10th Ministry Telangana Government Holidays 2026 – Full List of Public & Restricted Holidays

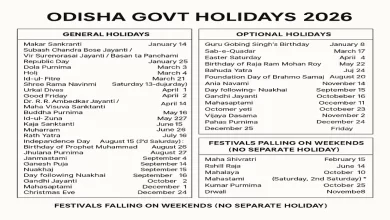

Telangana Government Holidays 2026 – Full List of Public & Restricted Holidays Odisha Government Holidays 2026 – Full List of Public and Optional Holidays

Odisha Government Holidays 2026 – Full List of Public and Optional Holidays