How to pay Chennai property tax online? How to use Chennai property tax calculator? Is there a way to get your Chennai property tax receipt online, check the payment status or change your phone number? What is the penalty for late payment?

If you own property in Chennai, you will need to pay property tax twice a year and will need to find answers to the above questions.

Property tax in Chennai is collected by the Greater Chennai Corporation (GCC). For its citizens, the Chennai Corporation has introduced Chennai property tax online payment and here are some of the most frequently asked questions about GCC property tax.

New portal to pay Property Tax In Chennai Corporation – https://chennaicorporation.gov.in/gcc/online-payment/property-tax/

You May Want To Read

- Chennai Corporation Complaint Numbers

- Chennai Metro Map, Timings, Routes, Fare, Stations

- Chennai Metro Water Booking

- Pay Chennai Water Tax Online

- Chennai Corporation Birth Certificate

FAQs On Chennai Property Tax

Find below answers to all the frequently asked questions about Chennai Corporation’s online property tax payment, status check and receipt download.

Trending Now

- Amrit Bharat Station Scheme – Full List Of State-Wise Stations

- Top Stores To Find A Dress On Rent In Jaipur

- River Cruises India – Top 8 Indian River Cruises For A Unique Holiday Experience

How to pay Chennai property tax online?

Paying property tax in Chennai Corporation online is pretty easy. Here’s what you need to do to pay Chennai property tax online:

Step 1: Visit the Chennai Corporation website

Step 2: Click on the button for Online Tax Payment

Step 3: Click on the button Online Payment

Step 4: Enter your property tax bill details; i.e., your zone number, ward number, bill no. and Sub no. These details are available on your property tax demand card. Click on Submit

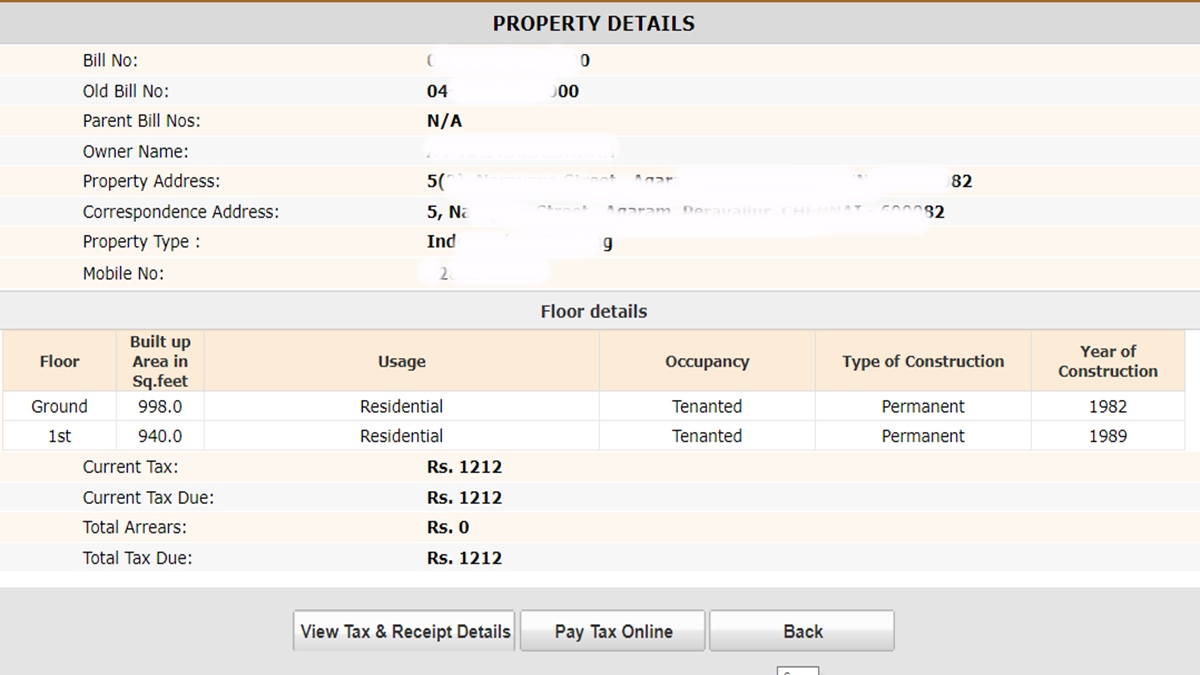

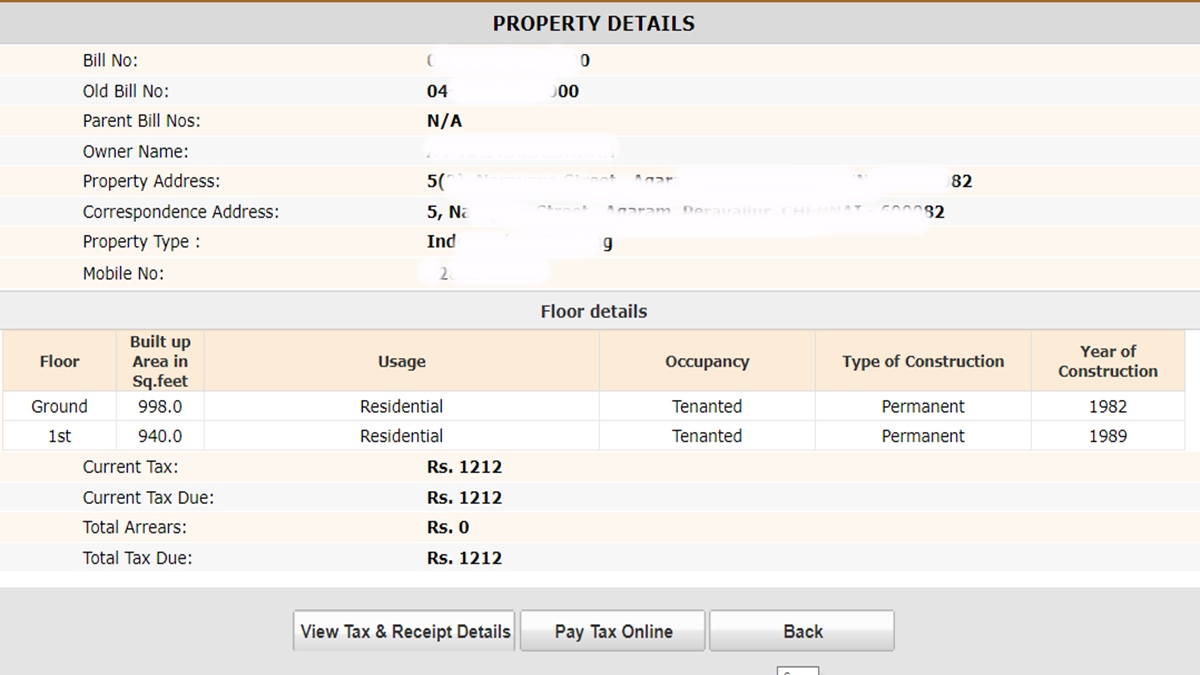

Step 5: The page will be refreshed to show all your property tax details. Check that they are correct and click on the button Pay tax online

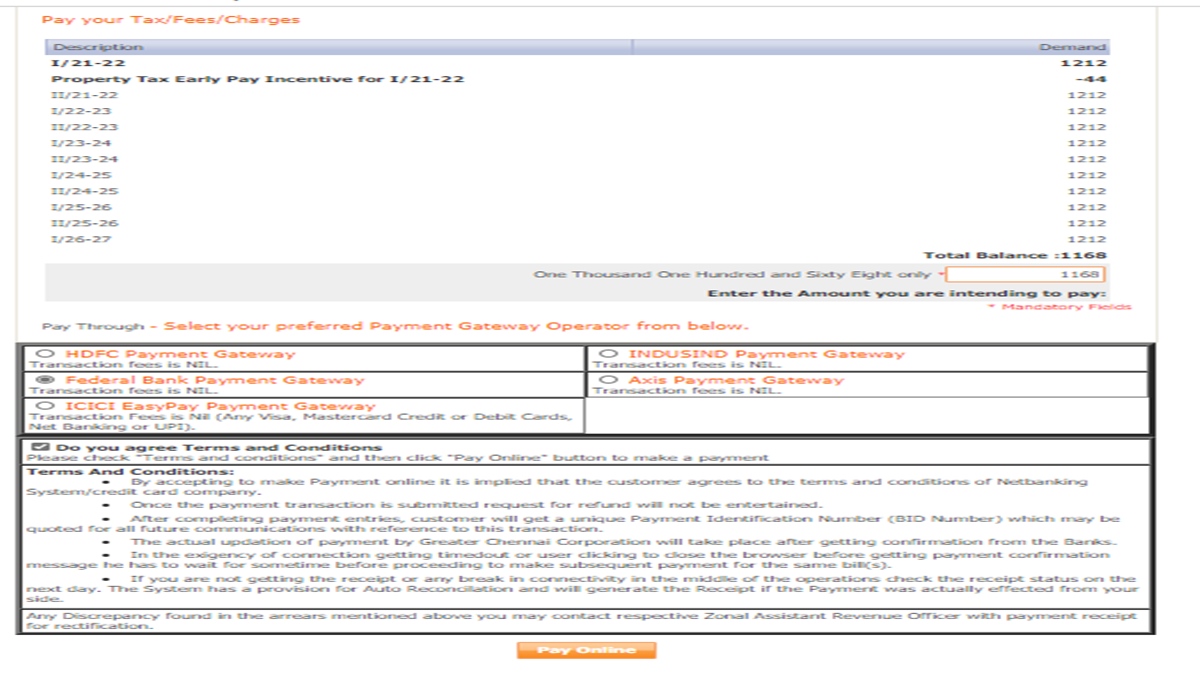

Step 6: Enter the amount to be paid and select your preferred payment gateway. You will also need to check the box to agree to the terms and conditions.

Step 7: Once the payment is made, a receipt for the Chennai property tax will be displayed with a reference number.

Step 8: You can save a copy of the receipt for Chennai property tax pay online or print it for your file. You can also visit the new portal – https://chennaicorporation.gov.in/gcc/online-payment/property-tax/

How to find your Chennai property tax zones online?

The rates for property tax in Chennai are not the same all over Chennai. They are dependent on the area. Chennai is divided into 15 zones for property tax purposes. The 15 zones are further divided into 200 wards. Thus, before you start the process for Chennai property tax online payment you must know your property zone. To find your zone:

Step 1: Visit the Chennai Corporation website

Step 2: Click on the button for Online Tax Payment on the left side menu

Step 3: Click on the Know your zone and division button

Step 4: Type in the area, location and street name. Click search.

Alternatively, you can see the list of all Chennai property tax zones by following the below steps:

Step 1: Visit the Chennai Corporation website

Step 2: Click on the button for ‘Online Tax Payment’

Step 3: Scroll down to the bottom of the page. On the footer, click ‘Zone Details’

Step 4: Click on the map to maximize the image.

How to use the Chennai property tax calculator?

The amount of Chennai Property tax you need to pay depends on where your property is located and the built-up area. You can calculate this online:

Step 1: Visit the Chennai Corporation website

Step 2: Click on the button for Online Civic Services

Step 3: Click on Property Tax

Step 4: Click on Property Tax Calculator

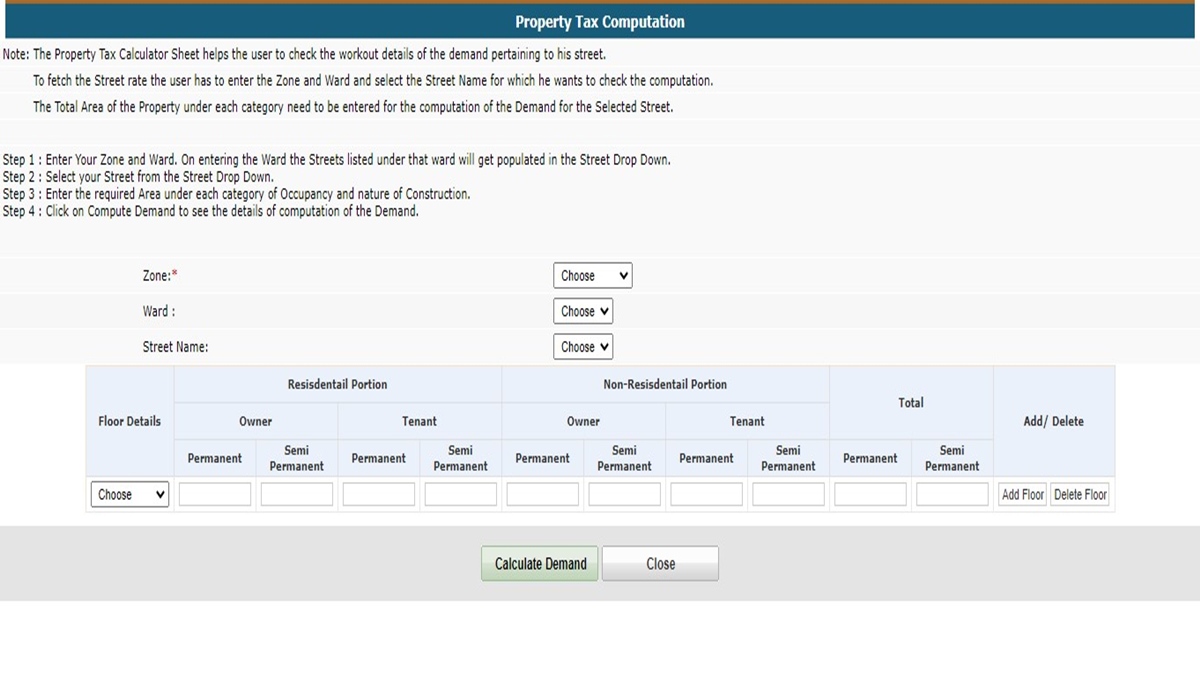

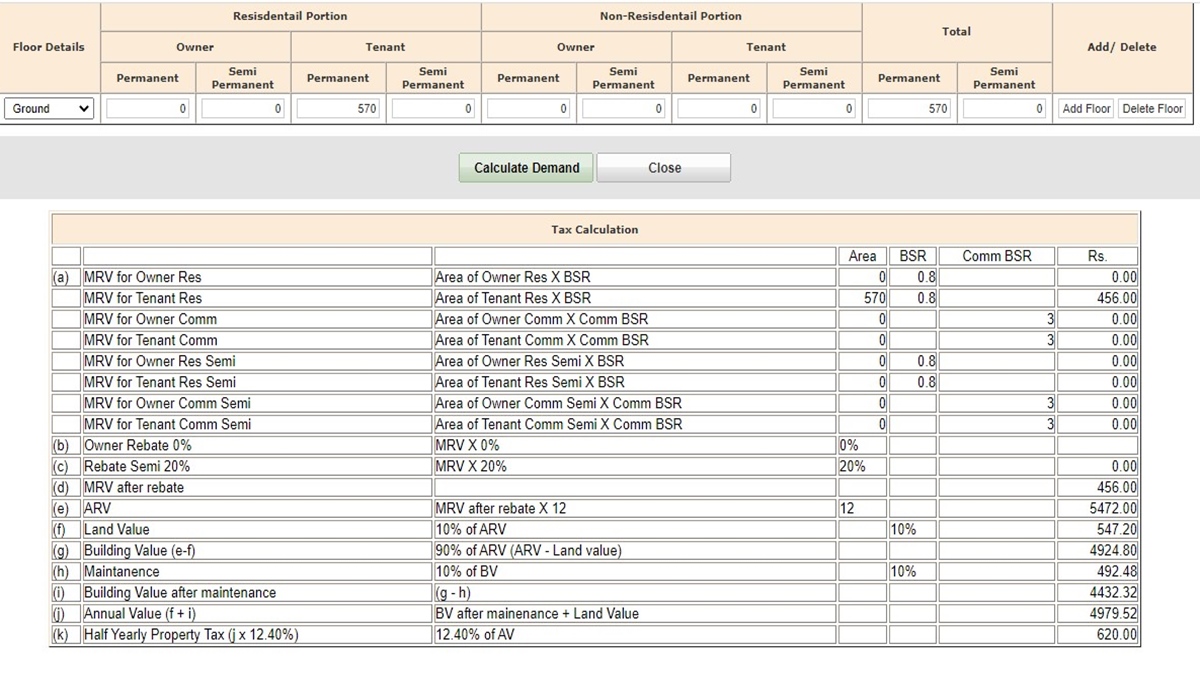

Step 5: Choose the zone, ward and street name from the drop-down menu. Under the section for Floor details, choose the floor you want to calculate property tax for and enter the area for the owner and tenant’s permanent and semi-permanent portions.

If your property has more than one floor, you can add details for the other floors also. When all the details have been entered, click on the button to Calculate demand.

When you scroll down, you will see the tax payable for your property.

How to download Chennai property tax receipt?

Once you pay your property tax in Chennai Corporation, you must maintain a file with all the payment receipts. Follow the below steps to download Chennai property tax receipt:

Step 1: Visit the Chennai Corporation website

Step 2: Click on the button for ‘Online Tax Payment’

Step 3: Click on the button for ‘Online Payment Receipt’

Step 4: enter all your details: zone number, division code, bill no. and Sub no. Click on the submit button.

Step 5: Confirm your account details and click on the button View tax & receipt details

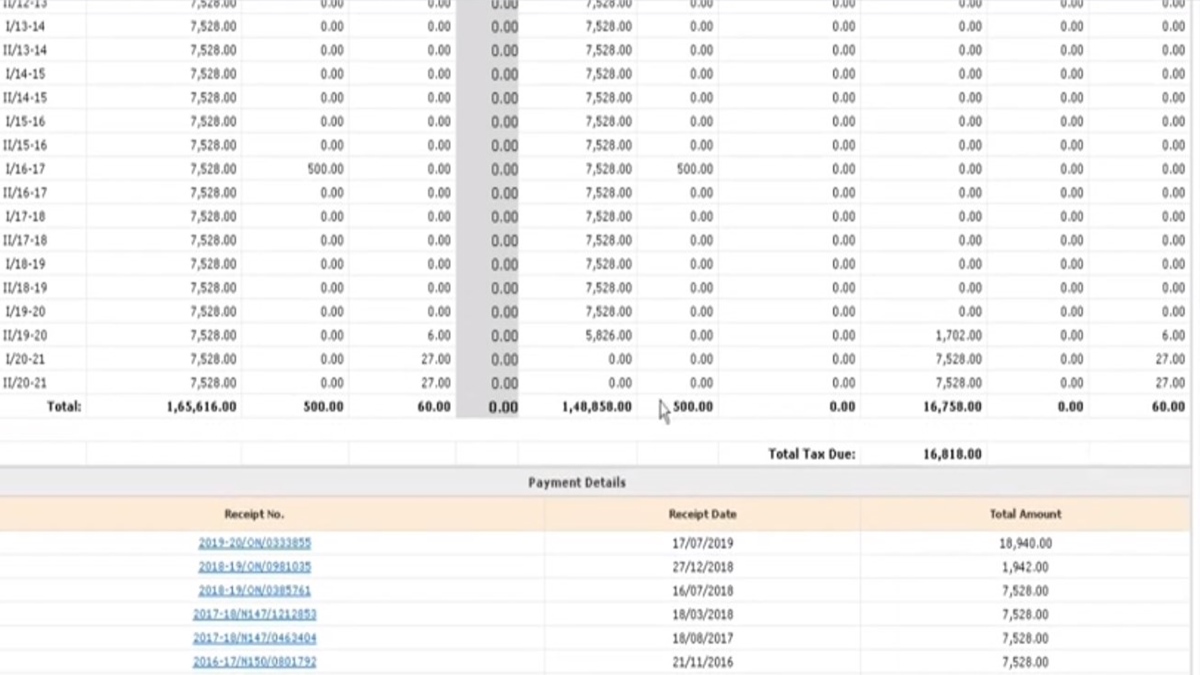

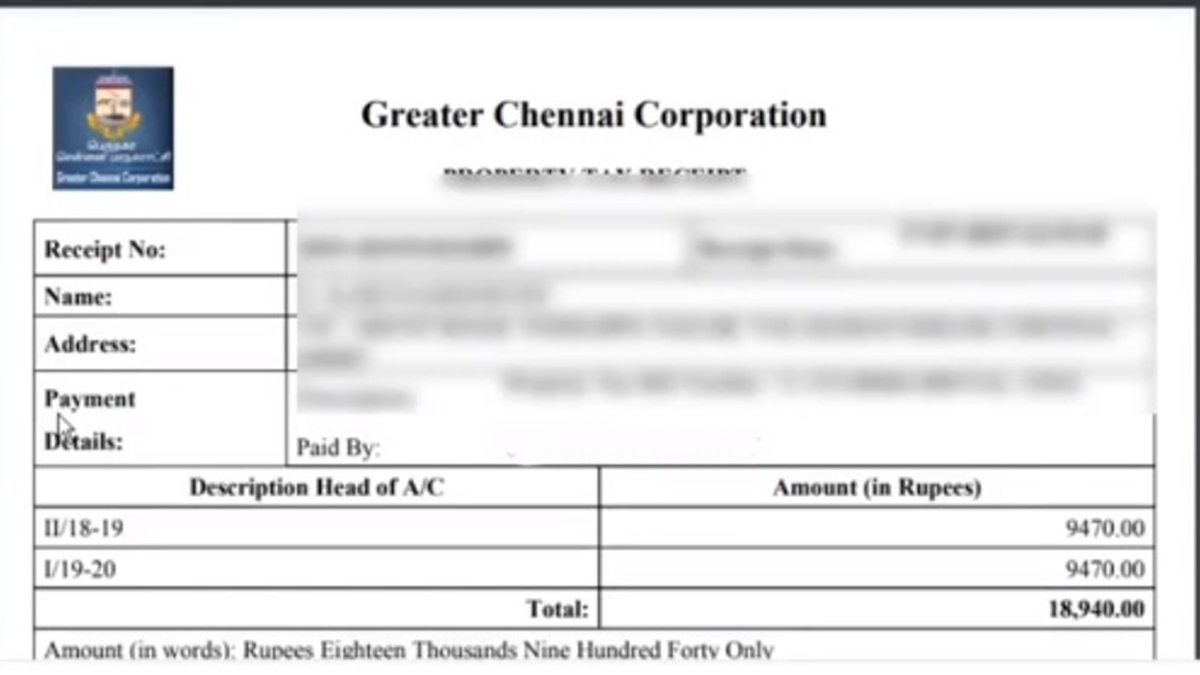

Step 6: You will see a list with all your past bills and payments. Scroll down to see a list of receipts. The first row should be the latest bill paid. Click on the Receipt number.

Step 7: The screen will refresh to show you a copy of the receipt. You can save it on your computer or print this receipt.

How can you check the corporation of Chennai property tax status?

Chennai property tax is payable twice a year. To check the status of your property tax, follow the steps below.

Step 1: Visit the Chennai Corporation website

Step 2: Click on the button Online Tax Payment to pay your Chennai Corporation property tax online

Step 3: Now, click on the button for Property Tax Status

Step 4: Enter the details such as zone number, division code, bill no. and Sub no. Once you enter the details, click on the submit button.

You will be able to see your Chennai property tax status. If you haven’t paid, your Chennai property you can also make the payment now.

What is the penalty for not paying Chennai property tax on time?

Property tax in Chennai is payable twice a year by the 31st of September and 31st of March. If the payment is not made on time, a penalty of 2% is charged.

What are the steps to change the Chennai property tax mobile number

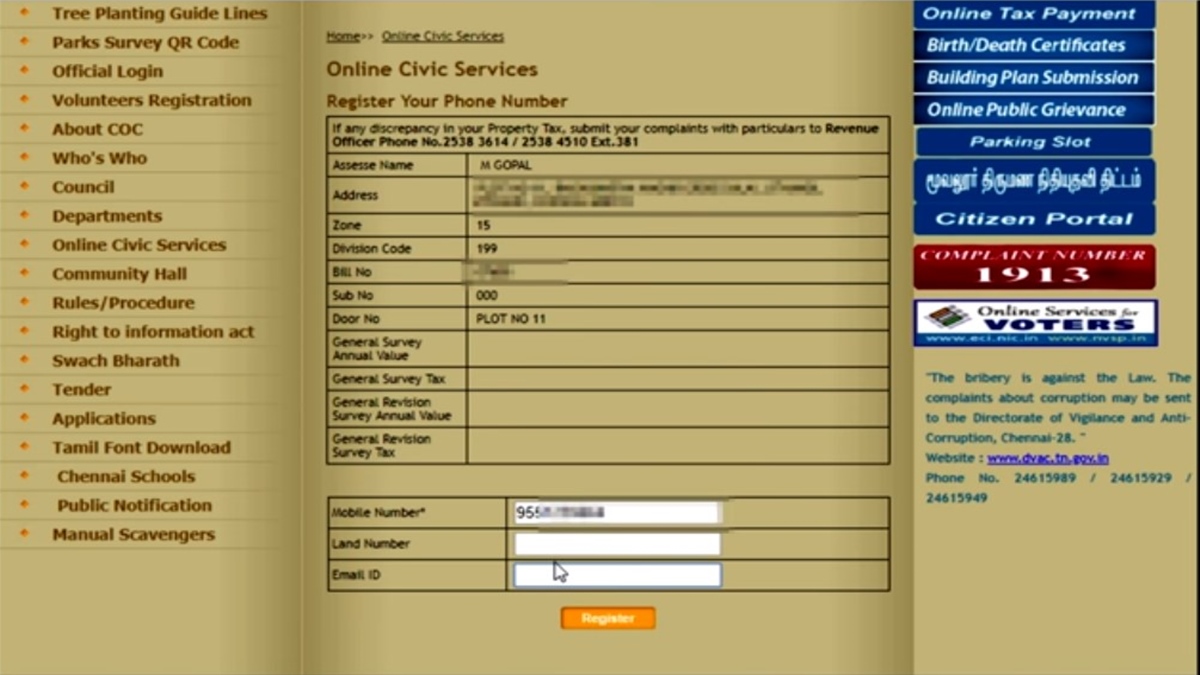

Once your mobile number is registered with the Chennai Municipal Cooperation, you will get all your property tax bills through SMS. The steps to do so are:

Step 1: Go to the Chennai Corporation website

Step 2: Click on the button for ‘Online Tax Payment’

Step 3: Click on the button for ‘Register your Phone Number’

Step 4: Enter all your details: zone number, division code, bill no. and Sub no. Click on the submit button.

Step 5: Confirm your details and enter your mobile number. You may also enter your landline number and email address. Click on the Register button

You will see a message saying your phone number has been registered

Other Useful Information

- Top 22 Hill Stations Near Chennai

- Hospitals And Apps For Online Doctor Consultation In Chennai

- How To Apply For A Driving License Online And More

- Sarathi Parivahan Online Services – A Step-By-Step Guide

- How To Get An International Driving License From India

NMMC Property Tax Payment Online – A Complete Guide On Navi Mumbai Property Tax

NMMC Property Tax Payment Online – A Complete Guide On Navi Mumbai Property Tax KMC Property Tax Online Payment, Download Receipt, Calculation And More

KMC Property Tax Online Payment, Download Receipt, Calculation And More How To Pay Chennai Water Tax Online

How To Pay Chennai Water Tax Online BBMP Property Tax Payment Online – The A To Z Of Property Tax Bangalore

BBMP Property Tax Payment Online – The A To Z Of Property Tax Bangalore PCMC Property Tax Payment Online – The A To Z Of Pimpri Chinchwad Property Tax

PCMC Property Tax Payment Online – The A To Z Of Pimpri Chinchwad Property Tax Pay Property Tax In Pune – Pay PMC Property Tax Online

Pay Property Tax In Pune – Pay PMC Property Tax Online Online Payment Of Hyderabad Property Tax – Top FAQs

Online Payment Of Hyderabad Property Tax – Top FAQs Property Tax In Mumbai – A Guide To Online BMC Property Tax Payment

Property Tax In Mumbai – A Guide To Online BMC Property Tax Payment