Own a property in Bengaluru? Here are the essentials you need to know to make your BBMP property tax payment online and offline.

Find out how to print and download BBMP property tax receipt, generate BBMP property tax challan, tax zones, payment status, rebate, name change and more. Read on to know the BBMP property tax 2020-21 last date.

Property owners in Bengaluru, owning any kind of real estate (residential or commercial) including vacant lands are liable to pay property tax annually. The Bhruhat Bengaluru Mahanagara Palike (BBMP) is the local administrative body in Bengaluru, which collects property tax.

Here is an attempt to answer the key questions you have about BBMP property tax payment Bangalore.

Forms Used For BBMP Property Tax Payment?

You can use the below forms to make your BBMP property tax payment online and offline

Show 102550100 entriesSearch:

| Form | When To Use |

| Form Vi(Yellow) | For properties exempted from property tax payment |

| Form V(Blue) | When there is any change in property |

| Form IV(White) | When there is no change intype of usage, built up area, or occupancy of the property etc |

| Form III(Green) | For Propoerties without both PID and Khatha |

| Form II(Pink) | For properties with Katha Number without PID |

| Form I (White) | For properties with PID numbers |

Apps And Services By Karnataka Government

Top Web Stories

BBMP Property Tax Payment Online -Top FAQs

Below listed are some of frequently asked questions about BBMP property tax payment system.

What types of properties are subject to BBMP Property Tax?

The following types of properties located within the BBMP area limits will attract BBMP Property Tax:

a) Residential buildings

b) Commercial Buildings, including towers, billboards and hoardings

c) Vacant lands

You can make all your BBMP property tax payment online or offline based on your convenience.

What properties are exempted from property tax Bangalore?

The following BBMP properties are exempted from property tax payment in Bangalore:

(a) land registered and used for agricultural purpose

b) places allocated and used solely for public worship, on which no rent is payable

c) rent free choultries and rented choultries where rent is used exclusively for charitable purposes

d) places used for the charitable purpose and for government approved philanthropic objectives, on which no rent is payable

e) charitable hospitals and dispensaries excluding any attached residential premise, on which no rent is payable

f) buildings or lands exclusively used as i) non-profit student hostels, ii) educational purposes by recognised institutions, iii) offices of and owned by, registered labor associations

g) government notified premises to be use for free recreational purposes without any income generation, burial or cremation ground

h) property owned and possessed by government, not used or intended to be used for residential or commercial purpose

i) ancient monuments protected as historical or archeological sites

j) notified hospitals and dispensaries maintained by railway administrations excluding attached residential quarters

What concession is available on BBMP property tax payment?

A concession of 50% on the Property Tax on any one of the land or building is available for:

i) Land owned by an ex-service person

ii) Land owned by the family of a deceased ex-service person

iii) Building owned by an ex-service person or deceased ex-service person, used for their own residence

Do note that BBMP property with exemption will however be liable to pay applicable service charges.

What is the BBMP property tax 2020-21 last date?

BBMP Property Tax is calculated for the period of April to March each year and tax for each fiscal year is due for payment by April 30 of the succeeding fiscal year.

The due dates for BBMP property tax payment online and offline is:

1) For single instalment payment – within 30th of April (which may be extended to May 30)

2) For payment in two instalments – May 30 for the 1st Instalment and November 29 for the 2nd payment. Penalty for delayed payment applies after these due dates.

Can I avail any BBMP property tax rebate?

BBMP offers a rebate of 5% on the property tax payable, if the entire tax for the year is paid within May 31, 2020.

What is the penalty for delay in BBMP property tax payment?

Any delay payment of BBMP property tax payment online and offline, beyond the due date will attract a penalty of 2% per month on the outstanding amount.

What are the ways to pay my BBMP property tax?

You have following options to pay the BBMP property tax payment:

1. BBMP property tax payment online through BBMP Property Tax Payment Portal

2. Generating a challan online through BBMP Property Tax Payment Portal and paying offline through cash/ cheque/ DD at any of the designed centers.

3. Offline payment at relevant authorized centers or authorized banks, by submitting the appropriate form.

How to make BBMP property tax payment offline?

Follow these steps for offline payment:

1) Fill up the appropriate application form. You can find some useful guidance from BBMP in filling the applicable forms here.

2) Visit your nearest Bangalore One center or the office of the concerned Assistant Revenue Officer.

3) Submit the application and make the payment as either cash (for tax payment below Rs. 1000/-), or as a Demand Draft or card payment.

Which Banks can accept BBMP property tax payment?

The following designated banks can accept payment of BBMP property tax:

1. Axis Bank

2. Canara Bank

3. Corporation Bank

4. HDFC Bank

5. ICICI Bank

6. IDBI

7. Indian Bank

8. Indian Overseas Bank

9. Induslnd Bank

10. ING Vysya Bank

11. Kotak Mahindra Bank

12. Maharashtra Bank

13. SBI

14. YES Bank

What are the details I need to pay BBMP property tax online?

Before you start your BBMP property tax payment online, you should know the following basic details about your property:

1. Type of usage of the property (residential, non residential, commercial etc.)

2. Zonal classification to which your property belongs

3. The dimension, built-up area and usage of the property

4. Any changes made in the existing structure or usage of your property in the current year

5. Details of any mobile towers, hoardings, parking in your property

Even if you are not a new property owner, you will need these details handy to verify the pre-filled details, while paying the property tax online.

How is BBMP property tax calculated?

BBMP uses the Unit Area Value (UAV) System, to calculate the BBMP property tax. The Unit Area Value system fixes price per unit value of the built-up area or carpet area of the property. Based on this price, the expected returns from the property are calculated. BBMP’s jurisdiction is divided into six value zones (A to F). The applicable property tax rates will differ, based on the zone in which your property is located.

What is the formula for BBMP property tax calculation?

BBMP uses the below formula for BBMP property tax calculation:

Property Tax Payable (K) = (G-I) x 20% + Cess (@24% of K).

G = Gross Unit area value calculated as X+Y+Z, where i) X = area of tenanted property x rate per sq ft of property x 10; Y = area of self occupied property x rate per sq ft of property x 10; Z = area for vehicle parking x rate per sq ft of parking area x 10

I = GxH/100

H = % of depreciation rate

How can I calculate my BBMP property tax?

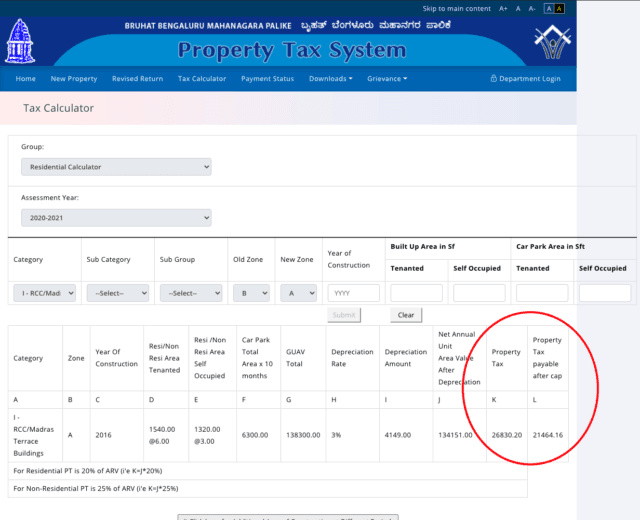

BBMP Property Tax calculation has been made fast and hassle free through the BBMP Property Tax Calculator. The following steps will guide you on how to use the BBMP Property Tax Calculator.

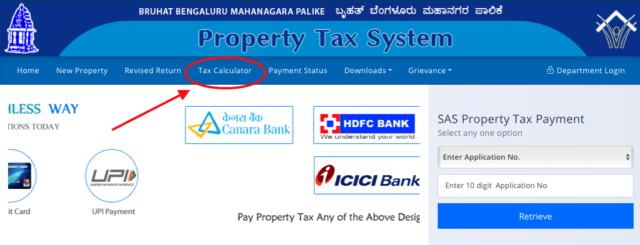

1) Visit the BBMP Property Tax System portal and click on ‘Tax Calculator’.

2) Choose the appropriate dropdown option under ‘Group’ and ‘Assessment Year’.

3) Select the category of your property, enter the zone, year of construction and other details.

4) Click ‘Submit’ and all your BBMP property tax details will be displayed.

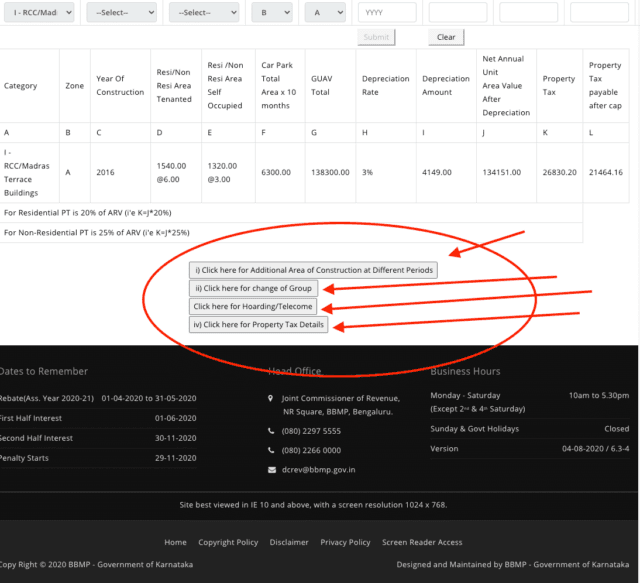

5) If you want more detailed information on the computation of your BBMP Property tax, click on the option iv) indicated below the display of the BBMP Tax Details as “Click here for Property Tax Details”.

6) If you have any additional area of construction on your property, click on the additional option.

7) If the nature of usage or occupancy has changed needing a change in Group, click the option (ii)

8) If you have a Hoarding/ Telecom tower in your property, click the option (iii)

How to find the BBMP property tax zone classification?

Detailed information on zonal classification can be found below. Check the complete List Of Bangalore BBMP Wards, Zones And Sub Divisions 2020. You will need the information to make your BBMP property tax payment online and offline

You can find the zonal classification of your property at http://bbmp.gov.in/en/web/guest/2016-17zonalclassification.

How to make BBMP property tax payment online?

Making BBMP property tax payment online is easy. The BBMP online payment portal enables easy, cashless and hassle free payment of property tax.

For the ease of understanding we have indicated the various steps you need to follow into three broad stages. You can follow these easy steps to pay your BBMP property tax payment online:

Stage 1– Login and verify owner details (Columns 1 to 4)

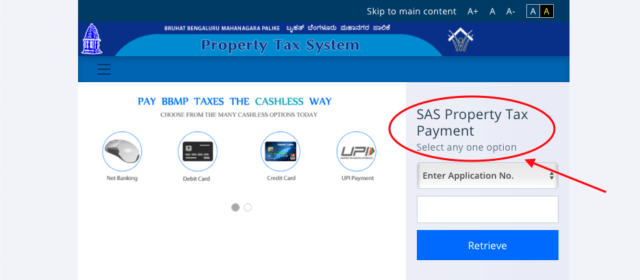

1) Visit BBMP Property Tax System Portal at http://bbmptax.karnataka.gov.in.

2) Enter your Base SAS application Number or the PID Number of your property. Click on the “Retrieve” option.

3) You will be able to view the details you have entered in the Base SAS application

4) If there is any change in the owner’s telephone Number, Mobile Number, occupation, age and email address, update the current details accurately in Column 3.

5) Update any change in postal address in column 4(g).

Stage 2 – Verify and correct the property details (Columns 5 to 8)

6) Choose appropriate zonal classification for your property. You find guidance here on how to choose the appropriate zonal classification, if there is a change in zonal classification of your property.

7) If there are any changes to the usage or existing structure of the property in the current year, enter the details of the changes in the appropriate column.

8) You will also need to declare the details of parking facilities, mobile towers or hoardings in your property in the specified column.

9) Verify the pre-filled details that you can see in all the columns.

Stage 3 – Auto Calculation of Tax Payable, Confirmation and Making Payment

10) The tax payable will be auto calculated.

11) You have the option to pay the property tax in two instalments. You need to choose if you are paying in one instalment or two instalments.

12) While paying online, you can click the option “Online Payment” and make the payment using your credit card, debit card, net banking or UPI Payment option.

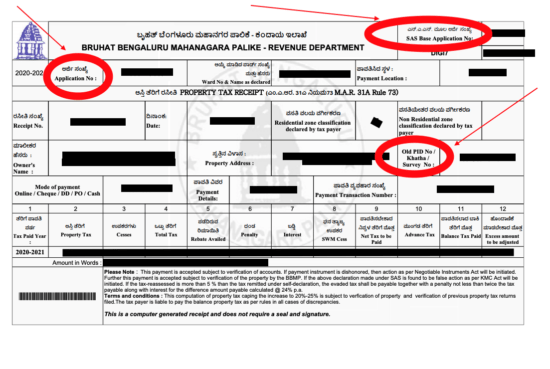

13) Once you make the payment, a receipt will be generated. It may take about 24 hours for the receipt to be generated.

14) If you wish to make payment as cash, cheque or DD, you need to choose the option “Challan” instead of online payment. This will generate a payment Challan that you can download and print, and use for payment of BBMP Property Tax at any Bangalore One centers, Designated Banks or Assistant Revenue Offices.

What is a BBMP property tax PID number?

PID Number is a unique Property Identification (PID) Number allocated to each property in Bangalore. The PID number is a combination of Ward number- Street Number-Plot number and forms a part of BBMP’s GIS based Property Tax System.

How can I find my PID number for BBMP Property Tax Payment?

You have the following options to find your PID number for BBMP property tax payment online or offline:

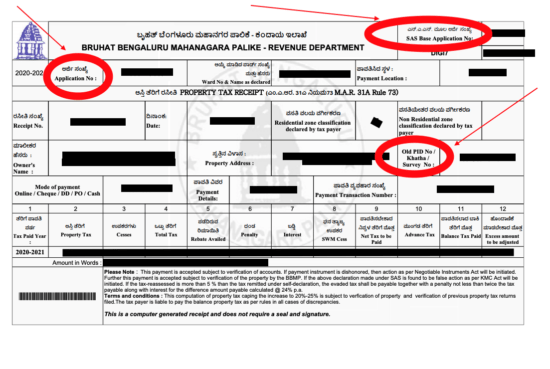

1) You can easily find the PID number from your tax receipt from previous years.

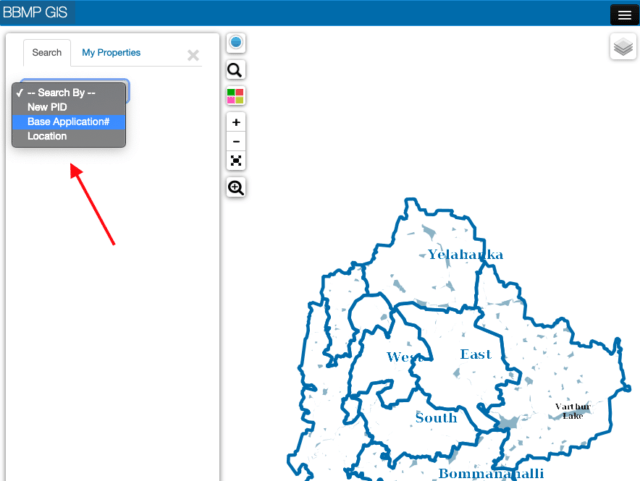

2) You can also search online the PID number of your BBMP property by following these steps, if you know your SAS Base Application Number, or atleast the ward number and location of your property:

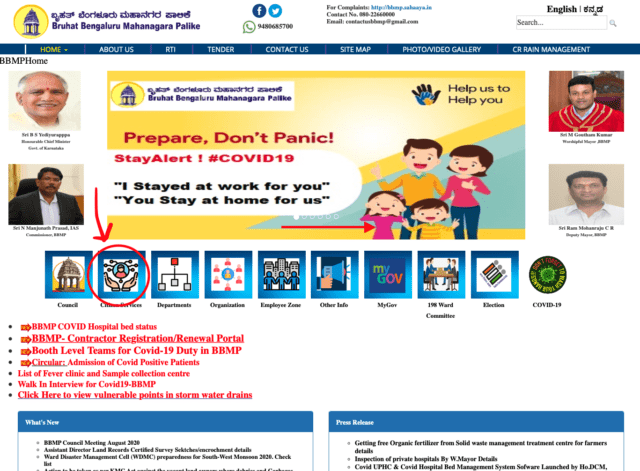

i) Visit bbmp.gov.in and click on ‘Citizen Services.’

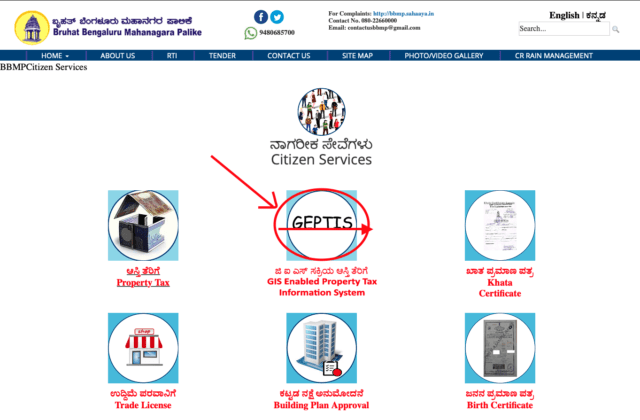

2) Click on “GEPTIS”GIS Enabled Property Tax System

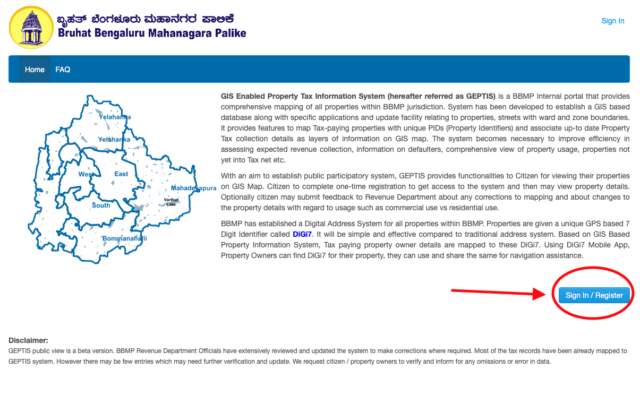

iii) You will be required to Register/ Login using your mobile number.

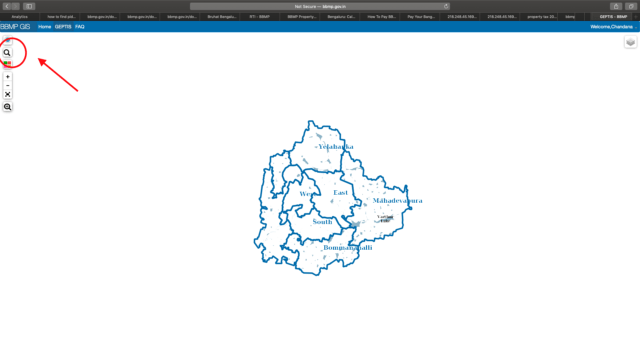

iv) Once you successfully login, you need to click the search icon on the left hand side of the screen.

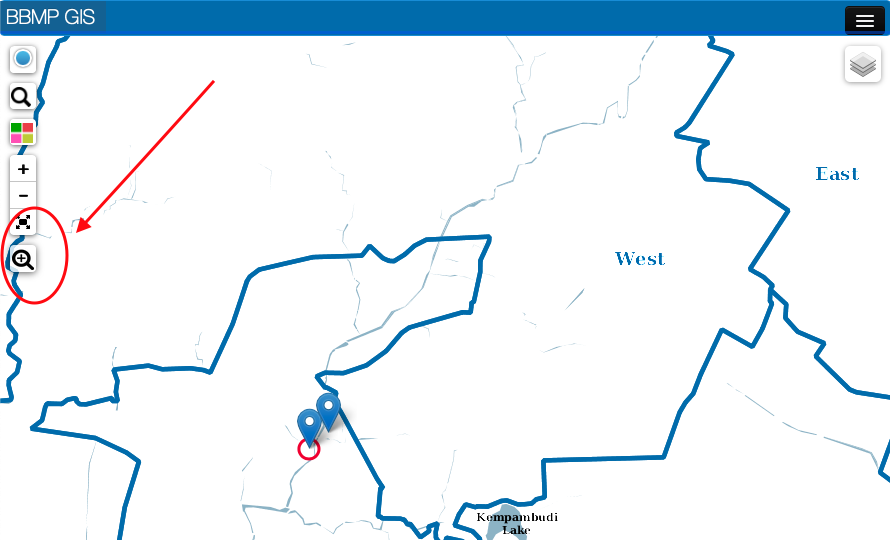

v) From the search dropdown options select‘Base Application #’and enter your SAS Base Application Number. The details of your property, along with the PID number details will be displayed.

vi) If you do not know any of the details, but know the ward number and approximate land mark of your property, you can use the last search icon on the left hand side, enter the ward number of your BBMP property and then find the property location on the map. Once you click on the property on the map the details along with PID number will be displayed.

vii) If you find that any of the details displayed about your property are incorrect, you can use the ‘Feedback’ button to submit corrections.

How can I find my Khata Number for BBMP property tax payment?

You can find the Katha No. of your property in your BBMP property tax receipt from previous years, or you can get the informaiton from your jurisdictional ARO.

Where can I view my BBMP property tax due details online?

You can easily find you property tax details, if you know any of the following details of your property:

i) Your 10 digit application number

ii) PID Number

iii) 2008-2015 Block renewal application number

Once you have any of these details ready, follow these steps:

1) Visit the BBMP Property Tax Payment Portal

2) Select either one of the drop-down option under the head ‘SAS Property Tax Payment’

3) Once you enter the relevant detail, for example PID Number and click on ‘Retrieve’, you will be asked to confirm the name of the property owner displayed. Once you confirm the owner, a pop up message will confirm that your tax payments have been done, if there are no tax dues.

4) If there are any dues on the BBMP property tax payment, after ticking the box to confirm any changes in property, click on ‘Proceed’.

5) You can view the details of your property tax dues, including the calculation, and make online payment once you verify the details.

How to check BBMP property tax payment status?

Follow the below steps to check your BBMP property tax payment status:

1) Visit BBMP Property Tax Payment Portal

2) Choose the option ‘Payment Status’, or click here for direct access to the page.

3) Enter either your Application Number, Challan Number or Transaction Number and click on ‘Retrieve’.

4) The details of all your previous BBMP property tax payment status will be displayed.

How to download BBMP property tax receipt?

To download your BBMP property tax receipt, follow the below steps:

1) Visit BBMP Property Tax Payment Portal

2) Click on ‘Downloads’ and choose the option ‘Receipt Print’. You can access this page directly here.

3) Select the assessment year.

4) Enter your 10 digit application number and the captcha.

5) Click on ‘Submit’ and a pdf copy of the receipt will be downloaded on to your device.

What BBMP property tax helpline?

Any complaints related to payment of property tax can be submitted to BBMP by the following means:

1) Register a grievance online at BBMP Grievance Portal.

2) Call the BBMP property tax helpline numbers: +91-080-2297-5555, +91-080-2266-0000

3) Send an Email: dcrev@bbmp.gov.in

How can I do BBMP property tax name change?

You can get your name changed in the BBMP Property Tax records, by submitting the requisite application to the BBMP Commissioner, along with the following documents:

1) Duly filled and signed application form

2) Most recent property tax paid receipt

3) Attested copy of the registered sale deed, with your name in it.

How to download BBMP Property Tax handbook?

BBMP has published a handbook for making property tax payments and related matter easy. You can view and download the handbook here.

How to update my mobile number for BBMP Property Tax?

You can update your mobile number for your BBMP Property Tax records, here.

What property corrections can be done by Assistance Revenue Officer (ARO)?

The details of property corrections you can do at the ARO can be found here.

Where can I find the help center details for my BBMP Property Tax Zones?

You can find the details of your zone wise help centers here.

You May Want To Read

- BWSSB Bill Payment Online

- BBMP Property Tax Payment

- File An Online FIR In Bangalore

- List Of BBMP Wards 2021

- Bangalore Metro Routes, Timings

- BBMP Trade License In Bangalore

- BESCOM Online Bill Payment

- Bangalore Traffic Fine Payment Online

Government Services

- mParivahan App

- Sarathi Parivahan

- DigiLocker App

- Parivahan Services

- Aadhar Card

- Ration Card

- Voter ID Card

- Driving License Online

NMMC Property Tax Payment Online – A Complete Guide On Navi Mumbai Property Tax

NMMC Property Tax Payment Online – A Complete Guide On Navi Mumbai Property Tax KMC Property Tax Online Payment, Download Receipt, Calculation And More

KMC Property Tax Online Payment, Download Receipt, Calculation And More How To Pay Chennai Water Tax Online

How To Pay Chennai Water Tax Online How To Pay Chennai Property Tax Online, Download Receipt And Check Payment Status?

How To Pay Chennai Property Tax Online, Download Receipt And Check Payment Status? PCMC Property Tax Payment Online – The A To Z Of Pimpri Chinchwad Property Tax

PCMC Property Tax Payment Online – The A To Z Of Pimpri Chinchwad Property Tax Pay Property Tax In Pune – Pay PMC Property Tax Online

Pay Property Tax In Pune – Pay PMC Property Tax Online Online Payment Of Hyderabad Property Tax – Top FAQs

Online Payment Of Hyderabad Property Tax – Top FAQs Property Tax In Mumbai – A Guide To Online BMC Property Tax Payment

Property Tax In Mumbai – A Guide To Online BMC Property Tax Payment