How To Pay Kerala Land Tax Online And Download Receipts

Paying Kerala land tax online and downloading receipts have gotten easier. All you have to do is visit the revenue department’s official website and follow the instructions.

The revenue e-payment system has been operational since 2015 allowing citizens to pay their land tax in Kerala from anywhere.

Here is a guide to Kerala land tax online quick pay and Kerala land tax receipt download online. You can make the land tax payment in Kerala offline as well by visiting the local government office.

Table of Contents

Read: Encumbrance Certificate In Kerala

How To Pay Kerala Land Tax Online? Download Receipt And Register On The Revenue Department Portal?

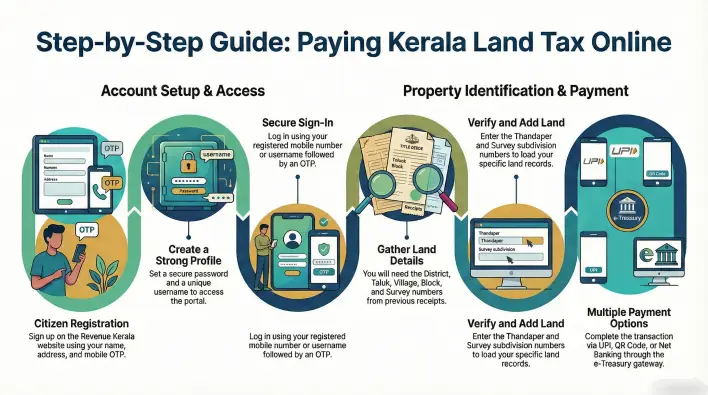

How To Register On The Revenue eservices Website?

Since the government has discounted the Kerala lax tax quick pay option, you need to register on the site to make land tax payment online in Kerala. The registartion is a one time process and you can login and pay post registartion. Let’s see how to register on the site.

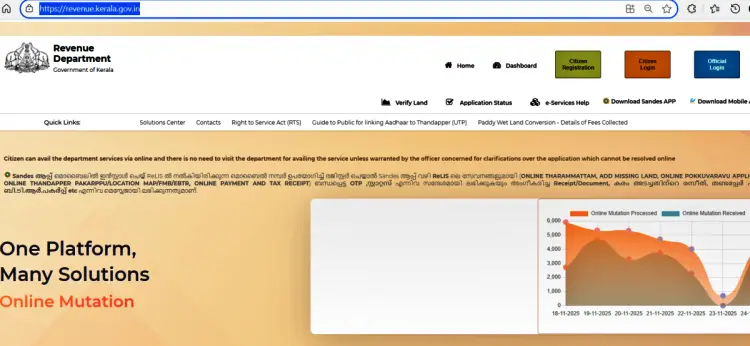

Step 1: Go to https://revenue.kerala.gov.in/

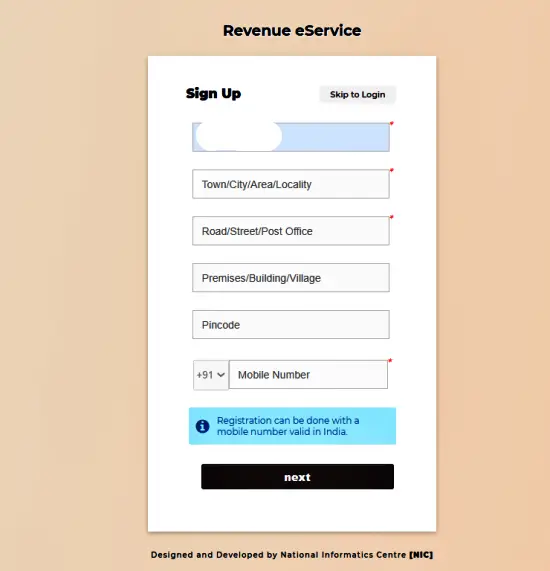

Step 2: Click on Citizen Registration

Step 3: A new window ill open asking you to complete the registration. Fill in the details. The below listed details are mandatory. So, keep them ready:

- Enter your name

- Enter town/area/locality

- Type in road/street/post office – Enter a mobile number valid in India. Note: (if you have used a mobile number as username, you can use the same one here.)

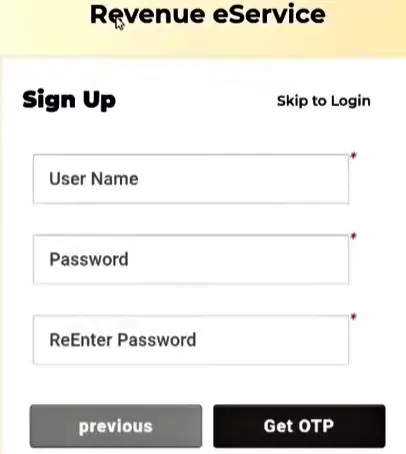

Step 3: Click Next and you will be redirected to a new window to sign up. Fill in the details. Remember your username and password as you will need these to login later.

Note: You will receive an OTP on your mobile. Enter the OTP → Submit → Registration completes. This creates your user profile for all land-record services.

Steps To Follow To Make Kerala Land Tax Payment Online

Follow the below steps, after registering on the site to make the payment. Before you start make sure you have:

- Thandaperu / Thandapperu number

- Survey or resurvey number

- Block number (if applicable)

- District, taluk and village name

- Mobile number (for OTP)

Note: You can find most of details on previous Kerala land tax online receipt or on the title deed – adharam

Once you have the above details, follow the below steps to make Kerala land tax payment online

Step 1: Go to https://revenue.kerala.gov.in/ and click on the Citizen Login option:

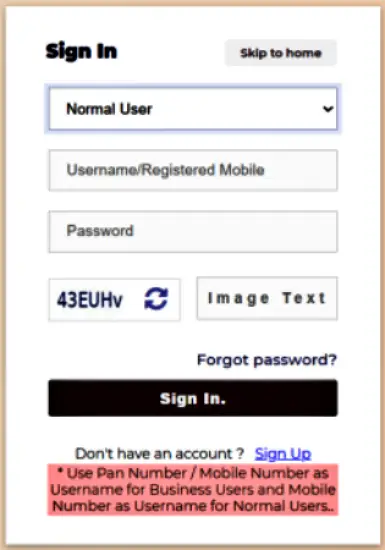

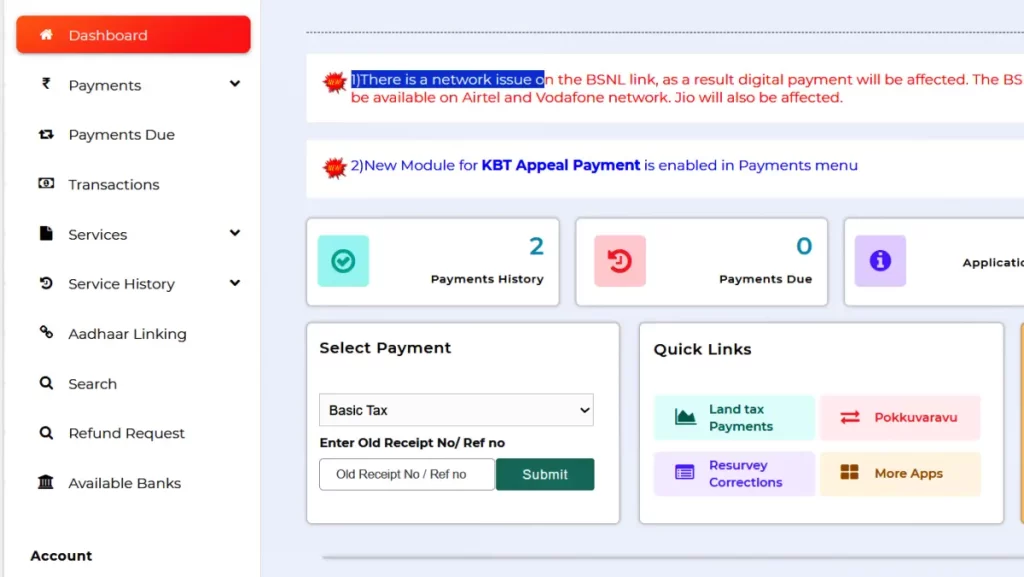

Step 2: Choose the user type – Normal or Business and fill the details and sign in to access your dashboard make Kerala land tax online payment.

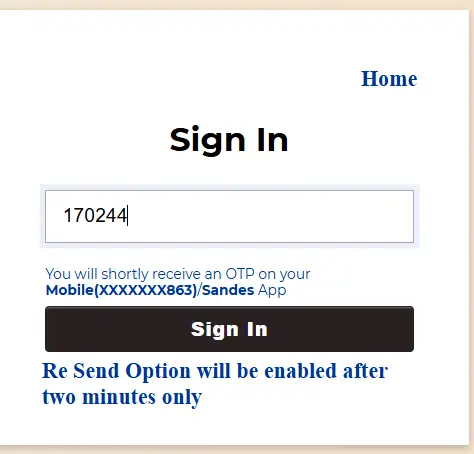

Once you enter the details, the below screen will appear, and you need to enter the OPT send to your restirred mobile number.

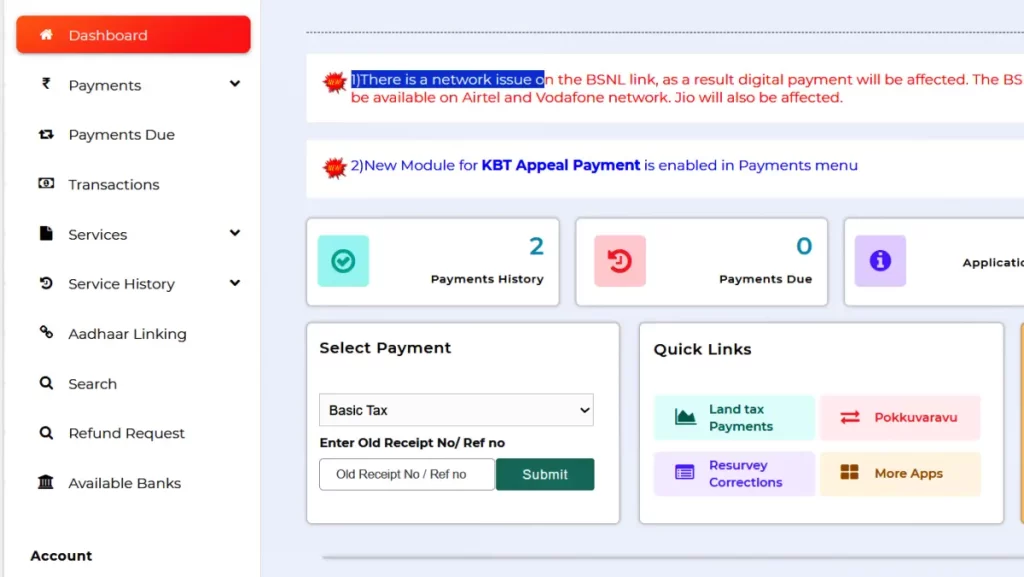

Now, you will be able to access your dashboard:

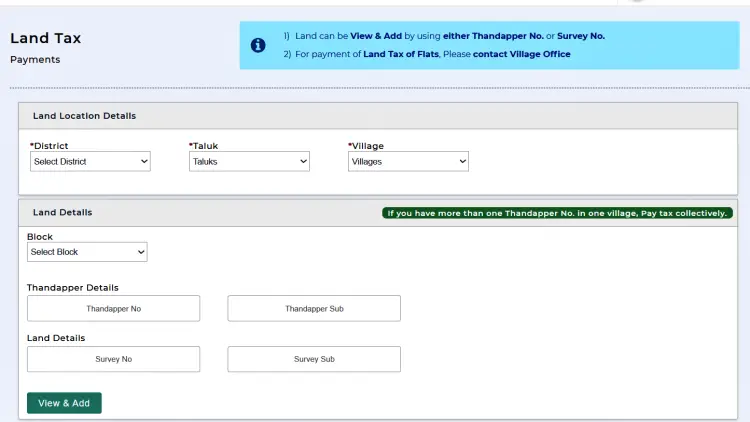

Step 3: Click on Land tax payment, under Quick Links and the below window will open. Fill in the land location and land details

Select the Land Tax cattails from the drop down: District, Taluks, Village, Block etc.

Now enter Land Details- Block, Thandapper details or Survey number details. Add and view. Your payment due will be shown on the screen. Choose your payment method and complete payment.

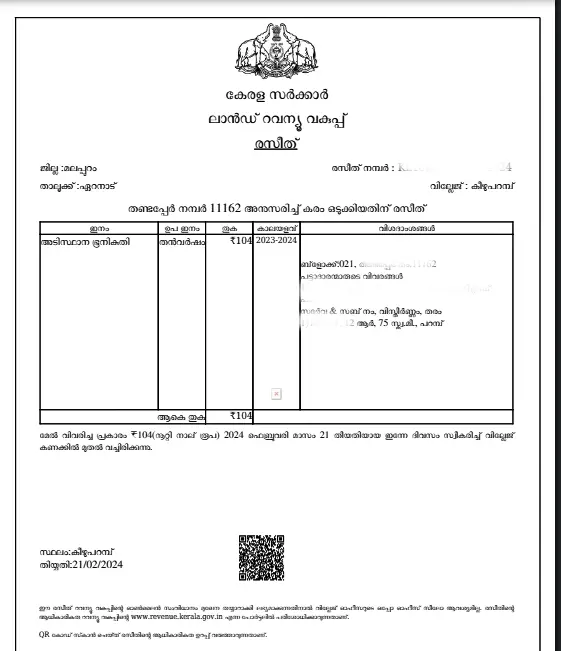

How to do Kerala land tax payment receipt download?

Step 1: To download the receipt, you need to login to Revenue eservices using Citizen Login. Use the registered mobile number and password to login and you can access you Dashboard

Step 3: Click on the payment history to view and download your receipt. Alternatively, you can also click on the Transactions on the left side and check your transaction history and download the receipt – like the one shown in the image below.

Kerala Land Tax Payment Offline – Find Answers To All Your Questions

If you are looking for answers to questions such as how to do Kerala land tax online quick pay or Kerala land tax receipt download, read on.

I only have the land deed and no Thandaperu or old receipts. How can I find my Thandaperu and pay Kerala tax?

If you only have the Aadharam (title deed), the Village Office can still identify your Thandaperu number. They verify your property using the survey or resurvey number in the deed and trace your entry in the land tax register. Once located, they update or confirm the record so you can pay tax normally.

How do I pay Kerala land tax for the first time or after many years of not paying?

Your method depends on whether your land details are already available in the digital system.

1. If the property appears online, you can pay through the Revenue Department website using your land details.

2. If the system cannot find your property, the Village Office must verify the deed, update the record, and generate a new tax entry. After this, they issue an online-format receipt, and future payments can be made online.

Can I pay Kerala land tax online without having a previous online receipt?

This depends on how complete your digital record is.

Some properties allow immediate online payment once you enter the Thandaperu, survey number, and block number. Others require verification and approval by the Village Office before the first online payment is allowed. If the portal cannot locate your land or shows errors, visiting the Village Office is necessary for updating the details.

The survey number in my deed is different from the one in tax records or online in Kerala. What should I do?

Survey number differences usually occur due to resurvey updates. The same land can have one number in old documents and a different subdivision in new digital records. Visit the Village Office with your deed and receipts so they can confirm the updated survey mapping and correct any discrepancies.

Is land tax the same as property tax in Kerala?

No, they are different. Land tax is for the land and is paid through the Revenue Department or Village Office.

Property or building tax is for the constructed building and is paid to the panchayat, municipality, or corporation.

Both taxes operate separately and use different online payment portals

How to do Kerala land tax online quick pay?

The revenue department has discontinued the Quick Pay option, and you need to register and login to pay Kerala land tax online. The registration is a onetime process.

Revenue Department Contacts

- Website: https://revenue.kerala.gov.in/

- Phone: 8547610009

- Email: itcelclr.revenue@kerala.gov.in

Contact Details Of State-Wise Nodal Officers

| State | Phone | Email ID |

|---|---|---|

| Thiruvananthapuram | 9400843557 | lisnodaloofficertvm@gov.in |

| Kollam | 7293009588 | reliskollam@nic.in |

| Pathanamthitta | 9497713703 | nodalofficerpta@kerala.gov.in |

| Alapuzha | 9961714971 | itcellalp.rev@kerala.gov.in |

| Kottayam | 7025406674 | nodalofficerktm@gmail.com |

| Idukki | 9447066946 | jyothi400849@kerala.gov.in |

| Ernakulam | 9497713707 | itcellekm.rev@kerala.gov.in |

| Thrissur | 9497713708 | nodalofficertsr@gmail.com |

| Palakkad | 9447945651 | hari.180453@kerala.gov.in |

| Malappuram | 9567097002 | relismlp@gmail.com |

| Kozhikode | 8921111382 | reliskkd@kerala.gov.in |

| Wayanad | 9746239313 | janisha.874583@kerala.gov.in |

| Kannur | 9656136700 | itcellknr1.ker@nic.in |

| Kasargode | 9995841716 | anas.838506@kerala.gov.in |

More From Kerala