How To Pay Kerala Land Tax Online And Download Receipts

Paying Kerala land tax online and downloading receipts have gotten easier. All you have to do is visit the revenue department’s official website and follow the instructions.

The revenue e-payment system has been operational since 2015 allowing citizens to pay their land tax in Kerala from anywhere.

Here is a guide to Kerala land tax online quick pay and Kerala land tax receipt download online. You can make the land tax payment in Kerala offline as well by visiting the local government office.

Read: Encumbrance Certificate In Kerala

Kerala Land Tax – Find Answers To All Your Questions

If you are looking for answers to questions such as how to do Kerala land tax online quick pay or Kerala land tax receipt download, read on.

What is Kerala land tax?

Land tax in Kerala is a tax charged by the government on the ownership of land. Certain types of lands such as agricultural lands are exempted from tax. Check with your local authority to know more about tax exemptions.

How can I pay land tax online in Kerala?

You can pay land tax online in Kerala by visiting the official website of the revenue department –https://revenue.kerala.gov.in/ . Check the next FAQ for a step-by-step guide.

How to do Kerala land tax online quick pay?

To do Kerala land tax online quick pay, follow the below steps:

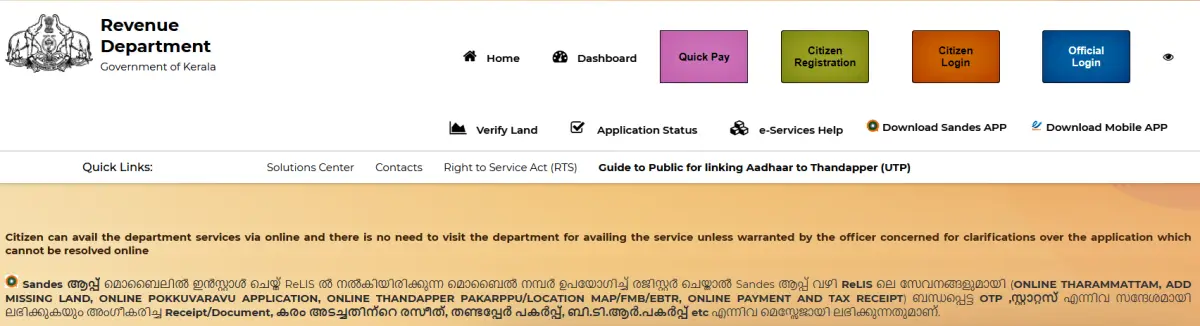

Step 1: Visit the official site of the revenue department –https://revenue.kerala.gov.in/

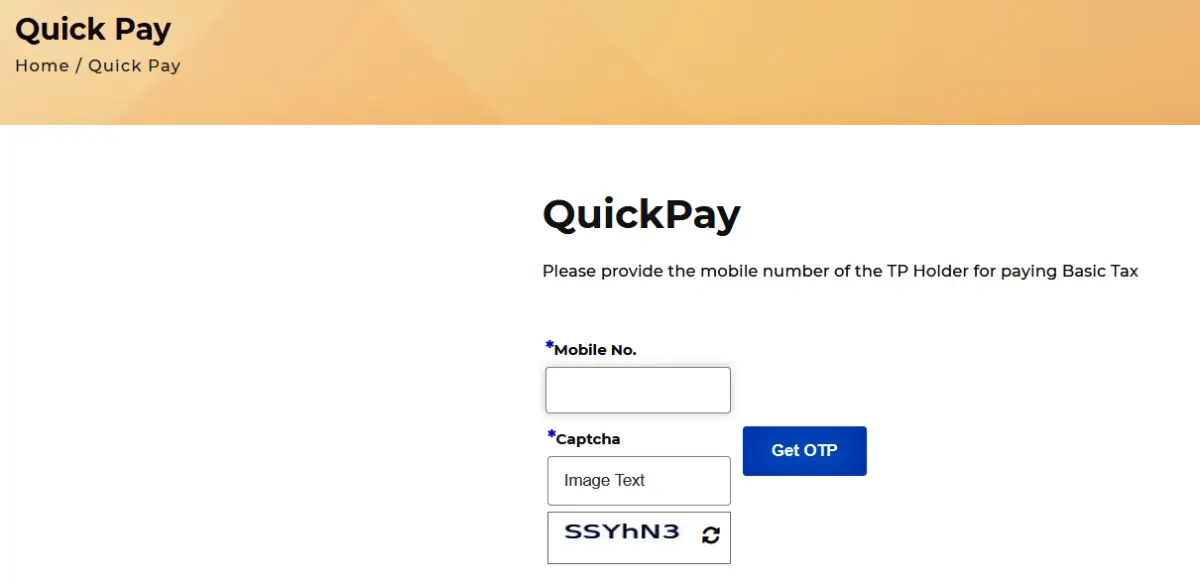

Step 2: Choose the quick pay option from the top menu.

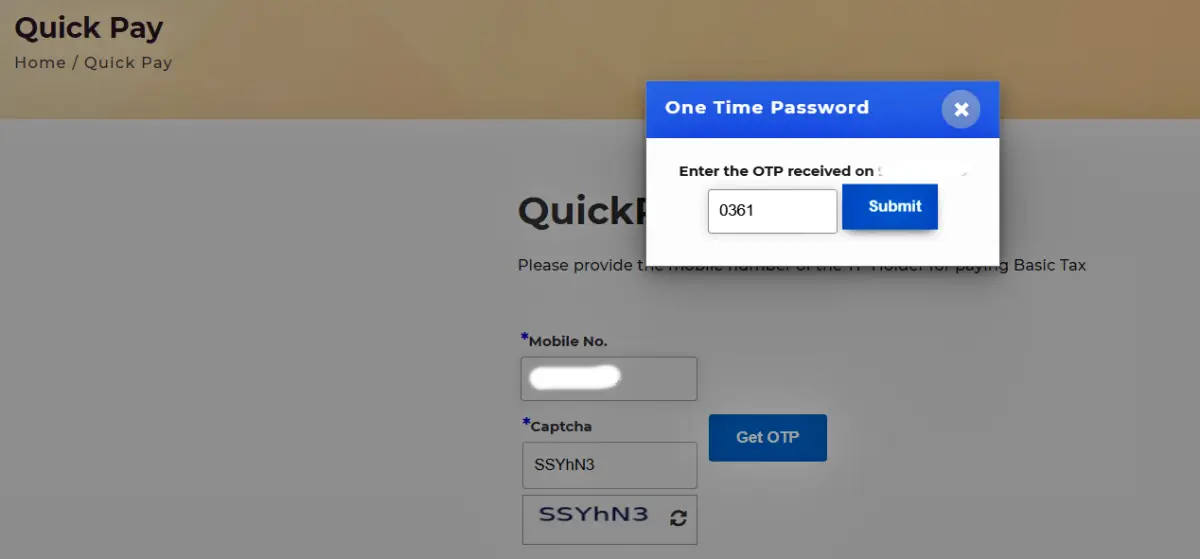

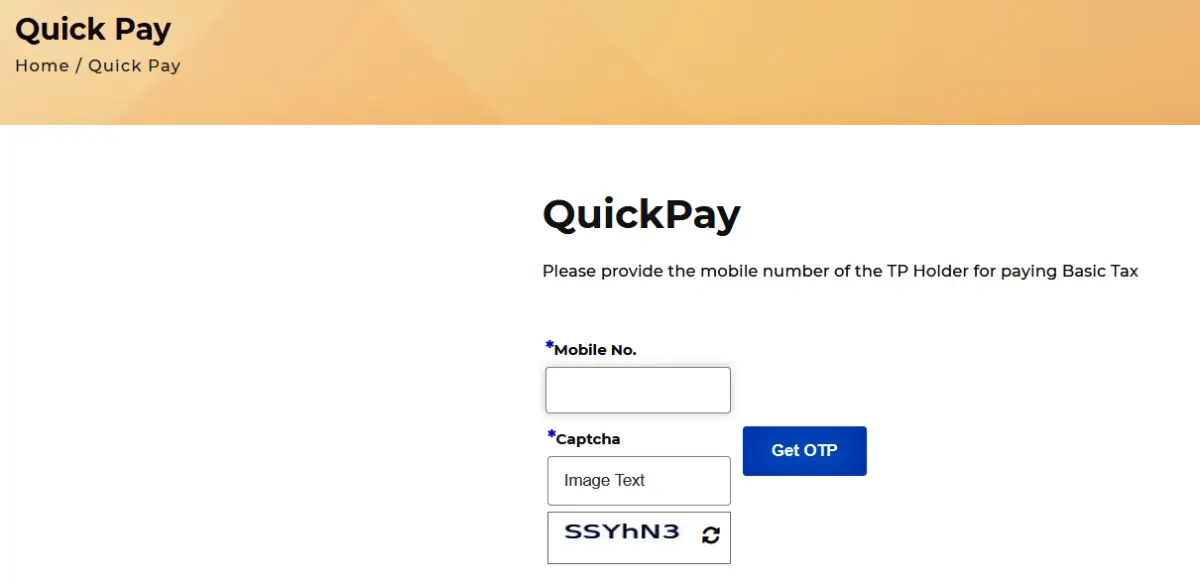

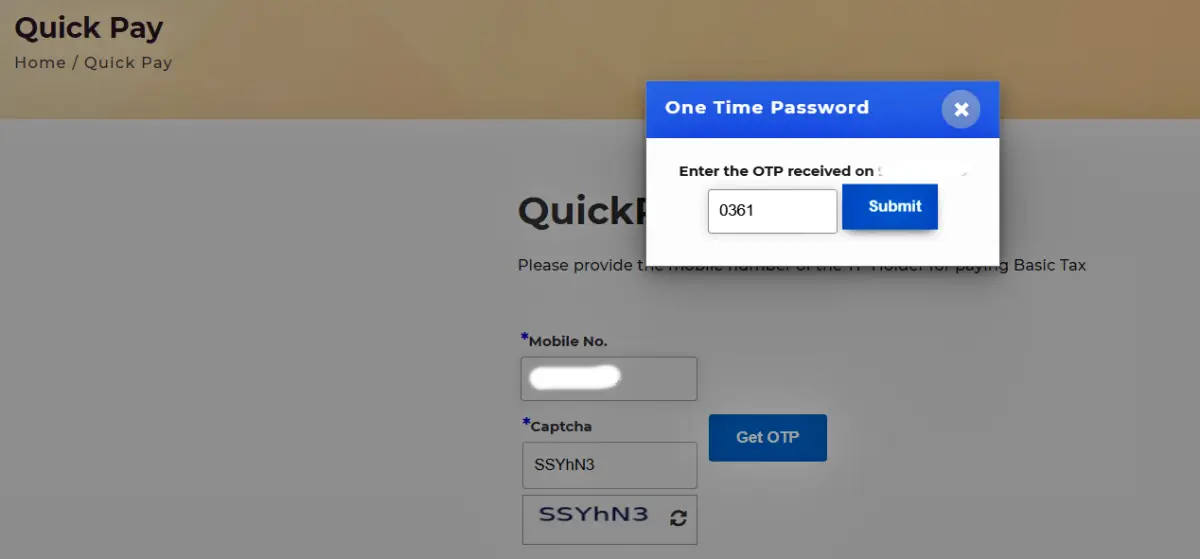

Step 3: Click on the quick pay option and you will be asked to key in your mobile number and the Captcha shown on the screen. Then click on Get OTP and enter the OTP in the popup box.

Note: You can use any phone number to pay land tax in Kerala using quick pay. It doesn’t have to be the landowner’s mobile number.

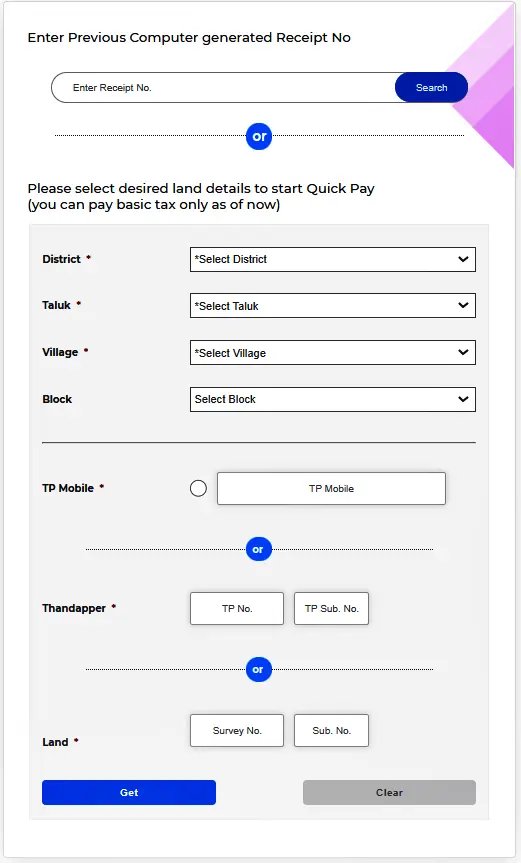

Step 4: You will be asked to enter the below details:

1. District

2. Taluk

3. Village

4. Block

5. TP Mobile – The mobile number used to link Aadhar with your land (if applicable)

6. Thandapper

7. Land survey number

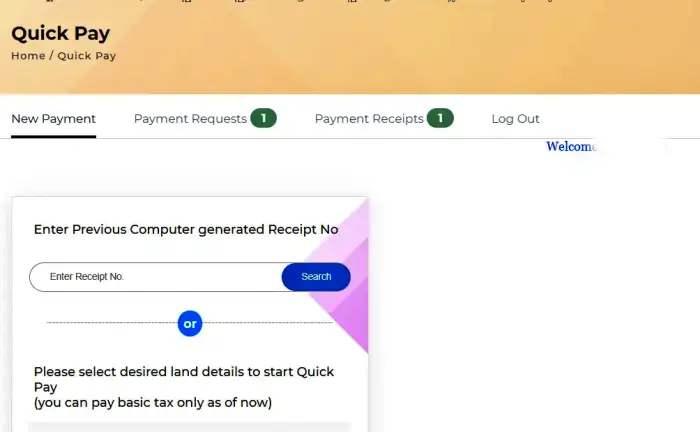

After choosing District, Taluk, Village, and Block, you can enter TP mobile, Thandapper, or Land survey number. Enter the relevant details and click on the Get button.

Step 5: Your land details and the tax amount will be displayed on the screen. Click on Pay Now. Confirm the details and click on Proceed For Payment.

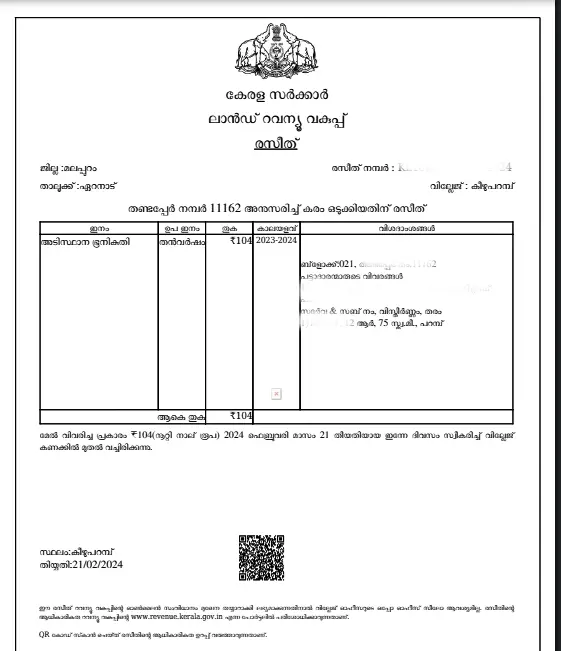

Step 6: Choose your payment method and complete the transaction. Save your payment receipt. You can also download the receipt later.

You can also search the details using the previously paid receipt number and the tax and your land details will be displayed on the screen and continue to make payment after verifying the details.

How to do Kerala land tax receipt download?

If you have paid your land tax in Kerala online, you can download the previous payment receipts online anytime anywhere.

Follow the below steps to do Kerala land tax receipt download online.

Step 1: Go to the Kerala Revenue Department’s official website and choose the quick pay option on the top menu.

Step 2: Enter your mobile number used while paying the land tax online and Captcha. Now, press Get OTP. Enter the OTP in the popup screen once you receive it.

Step 3: Now you can access the Dashboard and click on the Payment Receipts on the top menu. Your previous receipts will be displayed on the screen.

Step 4: Choose the receipt you want to download and the details will be displayed on the screen. Click on the Receipt option and your PDF receipt will be downloaded. Save it on your device for future use.

You can also register on the site and pay your land tax in Kerala online. Whether you choose to do quick pay or land tax payment after registration, there is not much difference. You can find and download previous payment receipts either way.

More From Kerala

- KWA Online Payment

- KSEB Bill Payment Online

- Marriage Certificate In Kerala

- Kochi Water Metro in Kerala