Kisan Credit Card Scheme – Are You Eligible?

Kisan Credit Card Scheme or KCC scheme is a Government of India initiative. The scheme was introduced to ensure that farmers in the country can take loans at a lower interest rate. The Kisan Credit Card loan helps farmers avail short term loans at an interest rate of 4% on the condition of timely repayment.

Kisan Credit Card Scheme – Highlights

- The credit limit can be increased up to INR 3 lakhs upon timely repayment of the loan

- Up to INR 1.60 lakhs can be borrowed without submitting any collateral

- The loan amount will be determined by banks based on the cultivation and post-harvest expenses

- The repayment period is determined based on the harvesting and marketing period

- The loan is insured by the crop insurance scheme

- KCC cardholders can get high interest on their savings

Kisan Credit Card Scheme – FAQs

Q: What is Kisan Credit Card Scheme?

A: Launched in 1989, the objective of the Kisan Credit Card scheme is to provide loans to farmers at a lower interest rate. In the 2020 Union Budget, the government has allocated INR 20,000 crores to sanction loans to KCC cardholders. As of 2018 March 31, there are 23,528,133 active KCC holders in India.

Q: What is the interest rate of Kisan Credit Card Scheme?

A. The interest rate is 4%. Upon prompt repayment, interest will be waived up to 3%. Late repayment can attract up to 7% of interest rate

Q: How to use KCC loan amount?

A: The loan amount can be used to cover the cost of:

1. Crop production

2. The maintenance of assets, dairy animals, etc.

3. Marketing

Q: Who is eligible for KCC loan?

A: Below listed are the eligibility criteria:

1. Farmers with minimum 18 years and maximum of 75 years of age can avail the loan

2. For senior citizens, a co-borrower who is a legal heir is mandatory

3. Individuals and tenant farmers, joint cultivators, owners, oral lessees and sharecroppers

4. Self Help Groups (SHGs) or joint liability groups

Q: What are the documents required to apply for Kisan Credit Card loan?

A: You need to submit documents that prove your identity, income and address:

Proof Of Identity

Aadhaar Card

Driving License

PAN Card

Passport

Voter’s ID Card

Or any other government approved photo ID

Proof Of Address

Aadhaar Card

Utility bills

Passport

Proof Of Income

Bank statement and salary slips for the last 3 months

Form 16

Audited financials for the last two years (for self-employed)

Q: Which are the banks that offer KCC loans?

National Bank for Agriculture and Rural Development (NABARD)

National Payments Corporation of India (NPCI)

State Bank of India (SBI)

Cooperative Banks

Industrial Development Bank of India (IDBI)

Q: How to apply for Kisan Credit Card loan?

You need to visit a bank of your choice and submit a loan application. Some banks let you download the form from their site. You will be asked to submit collateral if the loan amount is above INR 1.60 lakhs. Post processing, you will receive your Kisan Credit Card.

Check the banks’ website or call their customer care before you visit a branch to know more about the application procedure.

You can start using the loan once you receive the card. The fund can be used to buy seeds, fertilizers etc. Banks also provide checkbook and passbooks along with the card. By paying back the loan on time you can avoid cumulative interest.

Q: Can you apply for Kisan Credit Card online?

A: The application can’t be submitted online. However, you can download the application form online from Bank’s website. On the website, check for Kisan Credit Card section and download the application.

Once you download, fill the application and submit it at a nearby branch along with required documents. After verification, your card will be processed.

Q: How to get an SBI Kisan Credit Card?

A: To get an SBI Kisan credit card, download the form the website. Fill the form and submit it along with necessary documents at the nearest branch. You can also get the application form from the branch.

Q: What is the Kisan Credit Card helpline number?

A: The helpline numbers are:

Helpline: 011-2430-0606

Email: pmkisan-ict@gov.in

Q: Which is the official website of PM Kisan?

A: the official website is – https://pmkisan.gov.in/

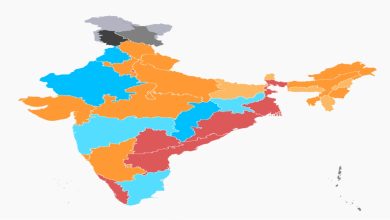

Q: What are the total number of Kisan Credit Card holders in India?

A: Below given are the number of operative KCC holders in the country:

| State | No. Of Operative KCCs |

|---|---|

| Andamans | 288 |

| Andhra Pradesh | 1,874,715 |

| Arunachal Pradesh | 8,779 |

| Assam | 583,215 |

| Bihar | 1,321,843 |

| Chandigarh | 3,536 |

| Chattisgarh | 228,163 |

| Dadra & Nagar Haveli | 535 |

| Daman & Diu | 391 |

| Delhi | 3,277 |

| Goa | 6,959 |

| Gujarat | 1,085,847 |

| Haryana | 676,683 |

| Himachal Pradesh | 213,124 |

| Jammu & Kashmir | 299,552 |

| Jharkhand | 600,314 |

| Karnataka | 893,415 |

| Kerala | 310,145 |

| Lakshadweep | 488 |

| Madhya Pradesh | 1,642,945 |

| Maharashtra | 2,203,906 |

| Manipur | 15,621 |

| Meghalaya | 5,4261 |

| Mizoram | 10,550 |

| Nagaland | 28,311 |

| Orissa | 654,844 |

| Puducherry | 4,394 |

| Punjab | 871,631 |

| Rajasthan | 2,039,917 |

| Sikkim | 4,809 |

| Tamil Nadu | 544,252 |

| Telangana | 1,796,333 |

| Tripura | 79,193 |

| Uttarakhand | 236,329 |

| Uttar Pradesh | 4,225,532 |

| West Bengal | 1,004,036 |

| Total | 23,528 133 |

Q: What is the interest rate of Kisan Credit Card?

A: The Kisan Credit card interest rate is 4% upon timely repayment of the loan. Below are conditions for interest rate waiver:

1. Kisan Credit Card interest rate upon prompt repayment: 3%.

2. Late payment: 7% on the amount