How To Apply For An Instant PAN Card

How to get PAN card with Aadhaar number online? How to download instant e pan card online? How to check the status of your instant PAN? How to convert an instant PAN card to physical PAN card? Read on to find answers to all your questions. How

A PAN card is a must-have for every Indian citizen who files income tax returns. This is a ten-character alphanumeric identifier. If you do not have a physical PAN card, you can apply for an instant PAN card and receive the same as a pdf file.

Instant PAN Card FAQs

The application process is online and can be completed in minutes. You might have a few questions like How to apply for an instant PAN card online? What are the steps for e-PAN card download? How long does the instant PAN card apply process take? We’ve curated the most frequently asked questions on this topic and get answers to all your doubts.

What is an instant PAN card?

An instant PAN card is an e-PAN card that is equitable to a printed PAN card.

Where can you apply for an instant PAN card?

You can apply for an instant PAN card online on the income tax website

How can you apply for an instant PAN card online?

You can apply for an instant PAN card online through the income tax website. Here’s what you need to do.

Step 1: Visit the official income tax website

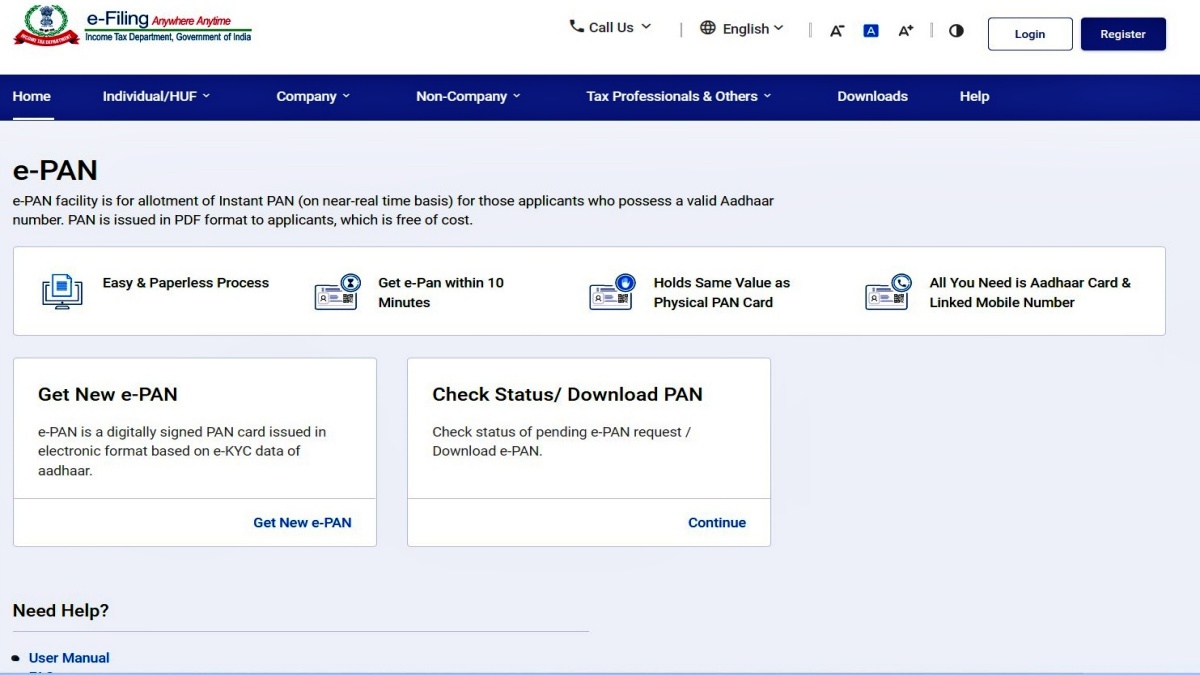

Step 2: Scroll down the page and click on Instant E-PAN

Step 3: Click on Get New e-PAN

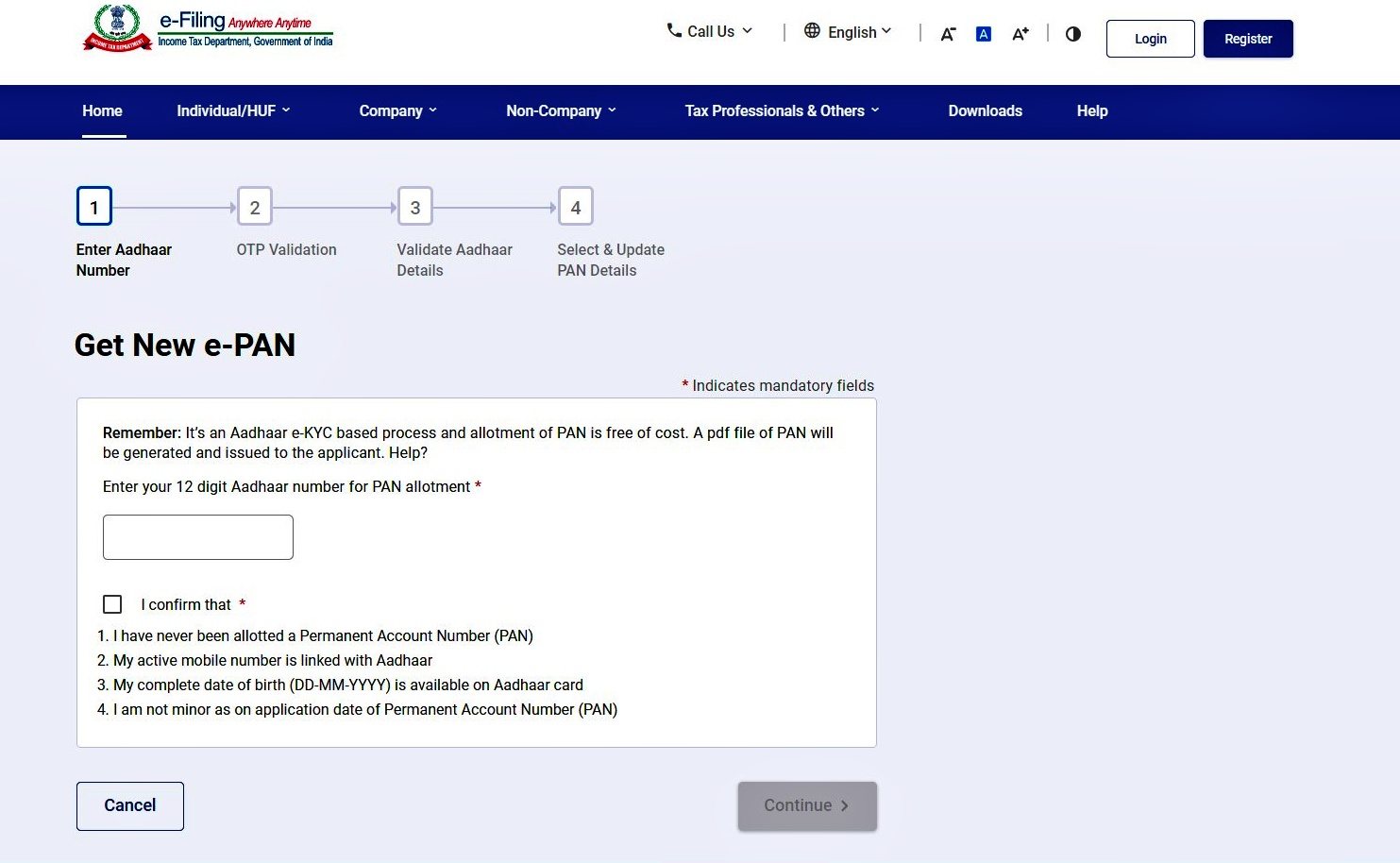

Step 4: Enter your Aadhaar number and confirm the declaration. Click on the Continue button.

Step 5: You will receive an OTP via SMS on your registered mobile number. Enter the OTP and confirm your Aadhaar card details.

Your application will be submitted and you will see an acknowledgment number.

Can you convert an instant PAN card to physical PAN card?

Once a PAN number has been allotted, you can convert an instant PAN card to physical PAN card. You can submit a request to reprint a PAN card here.

Please check the next question to see how to convert an instant PAN card to a physical PAN card.

How to reprint PAN card online?

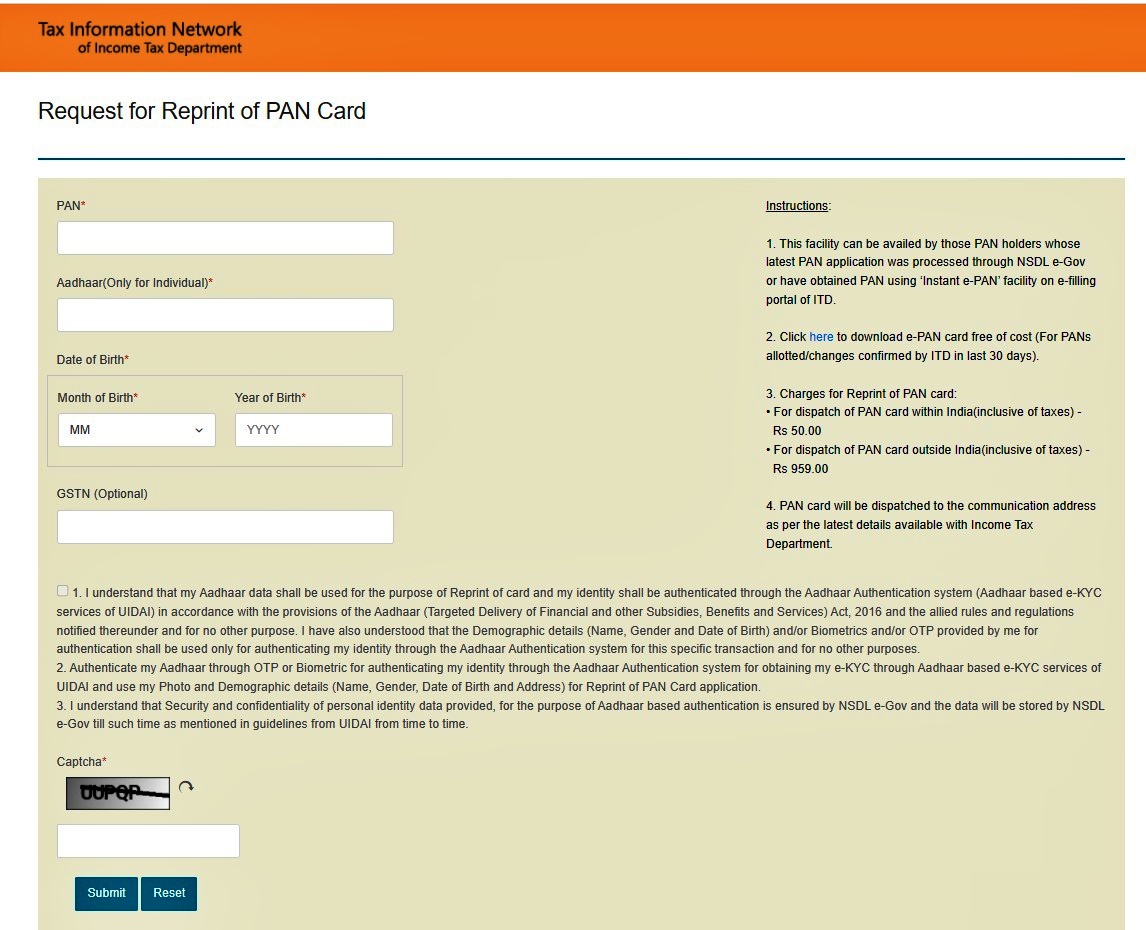

If you have an e-PAN, here’s what you need to know about how to reprint PAN card online or convert an instant PAN card to physical PAN card:

You can apply for this service here. Enter your PAN and Aadhaar details along with your Date of Birth. Accept the terms and enter the Captcha code before clicking on the Submit button.

The fee payable to dispatch the card to an address within India is Rs 50 and the fee payable to dispatch the card to an address abroad is Rs 959.

What are the steps for instant PAN card download?

There are 6 simple steps to be followed for instant PAN card download:

Step 1: Visit the official income tax website

Step 2: Click on Instant E-PAN

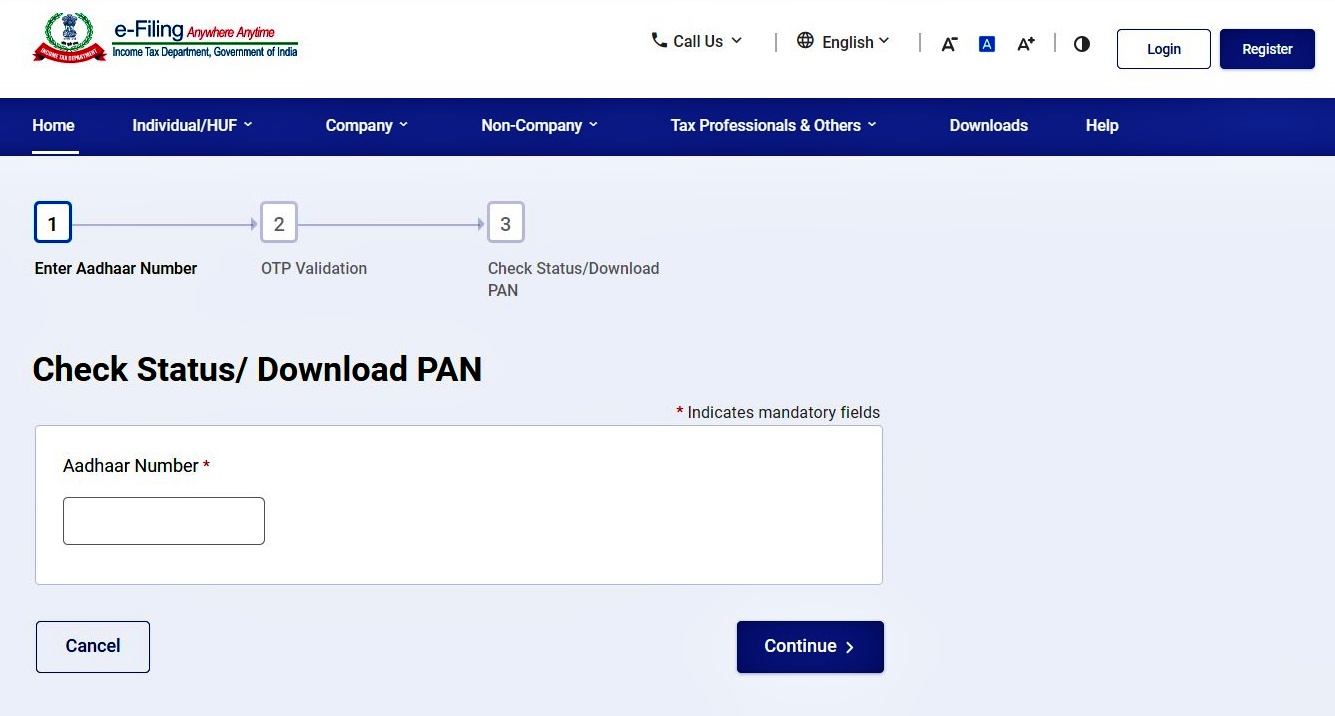

Step 3: Select Check Status/ Download PAN and click on the Continue button

Step 4: Enter your Aadhaar number and click on the Continue option.

Step 5: Enter the OTP as received on your registered mobile number.

Step 6: You will see a message saying ‘ Successful allotment of PAN’. Click on Download E-PAN.

In most cases, the PAN card is allotted instantly. However, in some cases, at step 6, you may see a message saying ‘Pending’. Revisit the website after an hour to get your PAN card.

How can you verify instant PAN card status?

In most cases, PAN cards are issued within minutes of submitting an application. Here’s what you need to do to check instant PAN card status

Step 1: Visit the official income tax website

Step 2: Select the Instant E-PAN tab

Step 3: Click on Check Status/ Download PAN

Step 4: Enter your 12-digit Aadhaar number and click on the Continue button.

Step 5: You will receive an OTP on your registered mobile number. Enter this OTP and click on the continue button.

You will be able to see if your PAN card has been issued or not. If yes, you can download a copy of the same. If not, you can revisit the website after an hour to recheck the status.

Who can use this service for instant PAN card apply with Aadhar?

Only those people who have an Aadhaar card but do not have a PAN card can use this service for instant PAN card apply with Aadhar. If you have a PAN card but have lost it, you cannot apply for a new e-PAN through this service.

How long does the instant PAN card apply process take?

In most cases, once you have gone through the instant PAN card apply steps, you will be issued a new e-PAN within minutes. In some cases, it could take an hour or two.

What can you do if your instant PAN card apply online status shows as failed?

After completing the instant PAN card apply online steps, if you see the status as ‘failed’, you can write an email to ePAN@incometax.gov.in.

What is the instant PAN card income tax link?

You will realize the instant PAN card income tax link when you file your tax returns. It is mandatory to quote this number when filing income tax returns.

What documents should you have before starting the instant PAN card online apply steps?

When it comes to instant PAN card online apply steps, all you need is your Aadhaar card and your registered mobile phone. The instant PAN card will be generated on the basis of your Aadhaar card details.

Can you get an instant PAN card without aadhar card?

No, you cannot apply for an instant PAN card without aadhar card

Can you get an instant PAN card for firm?

No, you cannot get an instant PAN card for firm online. This service is intended only for individuals.

How can you get an instant loan by PAN card?

When you apply for a loan, you must give your PAN card details to verify your identity and income. If you do not have a PAN card, you can get an instant loan by PAN card by applying for an e-PAN card online and submitting that in place of the hard copy PAN card.

What is an instant PAN card loan?

An instant PAN card loan is an unsecured loan that can be used as a personal loan. The money can be used to pay for medical expenses, emergencies, education, travel, weddings, etc. This loan must be paid back within 5 years.

Who can get an instant loan using PAN card?

To get an instant loan using PAN card, an individual must meet the following criteria:

1. You must be older than 21 years and younger than 60 years old.

2. You must have a net monthly income of at least Rs. 15,000.

3. Your income must be directly credited to your bank account.

4. You must have a CIBIL score higher than 700.